Question Strategic Management Accounting Case Study

(For assistance on how to answer this question you are advised to undertake the case study from Mars Petcare which is provided online in Module 2 as the Topic Reflection Task)

'Nutty Nut' Candy Coated Chocolate

STRATEGIC MARKET ANALYSIS

You have joined the cross-discipline Strategic Management Committee of the Confectionery Division within Jupiter Australia as the management accounting representative. The key issue facing this top level management committee at the moment is how to improve profitability in several key product categories.

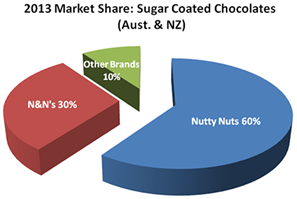

The product currently under discussion is the 'Nutty Nut' line of sugar coated chocolates sold by Jupiter through the major supermarket chains in Australia and New Zealand. The product has been a great success story for the Jupiter Confectionery Division however lately it has come under increased price competition and the sales and market share of 'Nutty Nut' chocolates have fallen dramatically. The major competition comes from a similar product branded as 'N&N's' which is manufactured by a multinational rival.

The Marketing Department for the Jupiter Confectionery Division has provided the following information about the sugar coated chocolate market during 2013:

The Marketing Department advises you that at the end of the 2012 year Nutty Nut's market share had been 80% and N & N's had been only 10%. Since that time N & N's have been advertising heavily and aggressively pricing their product in the market, increasing their market share to the current level of 30%. The marketing department believes that by discounting the wholesale sale price by $0.25 to $2.75, gross unit sales will increase by 20%. The research and development team have identified that by slightly altering the raw material mix a saving of 10% of prime costs can also be made.

As the Management Accounting representative you have provided the Strategic Management Committee with the following breakdown of revenues and costs for the 'Nutty Nut' product line for the just completed 2013 year:

|

Nutty Nut

|

|

|

Total Assets 'Nutty Nut' Factory

|

$30m

|

|

Total Sales (Volume in Units)

|

18m

|

|

Regular Retail Price (per unit retail price)

|

$3.99

|

|

Gross Sales Value Received (per unit wholesale price)

|

$3.20

|

|

Supermarket Rebates (per unit)

|

$0.20

|

|

Net Sales Value Received (per unit)

|

$3.00

|

|

Prime Costs (per unit)

|

$0.75

|

|

Other Manufacturing Costs (per unit)

|

$1.25

|

|

Logistic Costs (per unit)

|

$0.75

|

|

Gross $ Margin (Gross Profit) (per unit)

|

$0.25

|

|

Total $ Margin (Gross Profit)

|

$4.5m

|

|

% Margin on Net Sales Value

|

8.33%

|

|

% Return on Total Assets (ROTA)

|

15%

|

The CEO of Jupiter Confectionery, who is the Chair of the Strategic Committee, advises that even allowing for the 10% reduction in prime costs, discounting the product by $0.25 per unit will mean that the product will no longer achieve the firm's required return on total assets (ROTA) of 17.5%. ROTA is calculated by dividing Gross Profit by Total Assets and currently sits at 15%. The CEO argues that if this remains the case, the previously successful 'Nutty Nut' product line may have to be discontinued.

You advise the Committee that you are aware that the 'Nutty Nut' manufacturing facility is currently running at 53% of its practical capacity and that the warehouse facility (logistics) is running at 62% capacity. You are also aware that whilst the 'Nutty Nut' product's Prime Costs are 100% Variable, Other Manufacturing Costs and Logistic Costs are made up of 80% Fixed and 20% Variable cost.

It can be assumed that this cost break-down between variable and fixed costs will hold consistently across the industry (including for the 'N & N' competitor). Assume 90% of the predicted 'Nutty Nut' unit sales increase is made at the expense of their main competitor 'N&Ns' unit sales. Finally, assume that 'N&N' costs start out the same as 'Nutty Nut' and that the competitors make no immediate competitive adjustment to their offering.

You ask if you can be given time to prepare a report for the Strategic Committee on the cost and profit implications of the proposed changes and resultant increase in sales and production.

(i) Using excel prepare a 'before and after' comparative analysis of the revenues and costs of the 'Nutty Nut' product line incorporating the 20% predicted sales increase and the 10% predicted savings in prime costs (Ensure you include any impact of the production increase on manufacturing and logistics costs in your analysis).

(ii) Prepare a brief report (approx. 300 words) for the Strategic Management Committee outlining the key points of your findings. Include some discussion on:

a. the likely impact of the changes on the cost and profit structure of Jupiter Confectionery (derived from your answer to (i)).

b. Calculate and discuss the likely impact of the changes on the cost structure of 'N&N's' our main competitor (use Excel).

c. Make a recommendation to the Committee on whether to go ahead with the planned changes. Include any other strategic advice that you consider relevant to the Committee's decision making.