Question: Should E-Commerce Be Taxed?

A lot of buying and selling occurs on the Internet-so much, in fact, that rumblings of an e-commerce sales tax have become a roar. In 2005 more than 700,000 people in the United States earned either full- or part-time income on eBay. This statistic alone ensures that a tax showdown between the IRS and e-commerce retailers is on the horizon. Can you sift through the debate to determine whether or not buying and selling online should be subject to taxation? As you read the selections, ask yourself: "Should e-commerce be taxed?"

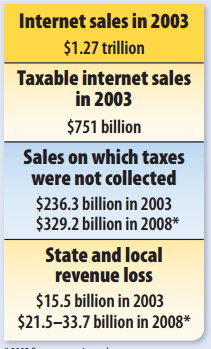

PRO SALES TAX REVENUE LOSSES: Inability to collect the [e-commerce sales] tax potentially has a number of important implications. Firms have an incentive to locate production and sales activity to avoid tax collection responsibility, thereby imposing economic efficiency losses on the overall economy. The sales tax becomes more regressive as those who are least able to purchase online are more likely to pay sales taxes than those who purchase online more frequently. Further, state and local government tax revenues are reduced. The Census Bureau reports a combined $1.16 trillion in e-commerce transactions by manufacturers, whole salers, service providers, and retailers, and Forrester Research, Inc.'s expectations continue to be for strong growth in e-commerce in coming years. Thus, the revenue erosion continues to represent a significant loss to state and local government.

CON ONLINE TAX PROPOSAL MISGUIDED: The Direct Marketing Association (DMA) is cautioning legislators about bills introduced . . . that would allow states to force online sellers to collect sales taxes for all state and local taxing jurisdictions. . . . The failure of . . . these bills to address a reduction in the number of tax jurisdictions is a key flaw, and remains a critical obstacle to a workable streamlined sales tax program. There are currently approximately 7,600 different sales tax jurisdictions in this country, including states, counties and municipalities, and even block-by-block areas that collect additional sales taxes, such as sewer districts, sports arena districts or library districts. Currently, only businesses with a physical presence or "nexus" within a state are required to collect taxes for the jurisdictions within that state. . . . The bills would also create a barrier to entry for small entrepreneurs, who rely on the Internet to help create markets, and a barrier to growth for medium-sized businesses seeking to grow

Operations or expand a customer base. Many would not be able to afford the effort and expense it would take to collect and remit sales taxes for each of the thousands of jurisdictions, much less the cost of a possible audit at any time by 46 different state revenue departments.

Analyzing the Issue Question

1. Identifying 1. Identifying What is the main argument in support of an e-commerce sales tax?

2. Summarizing Why does the DMA think it is not possible for online merchants to implement sales taxes?

3. Deciding 3. Deciding With which opinion do you agree? Explain your reasoning.