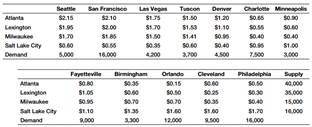

Question: Shafer Office Supplies has four distribution centers, located in Atlanta, Lexington, Milwaukee, and Salt Lake City, and ships to 12 retail stores, located in Seattle, San Francisco, Las Vegas, Tuscon, Denver, Charlotte, Minneapolis, Fayetteville, Birmingham, Orlando, Cleveland, and Philadelphia. The company wants to minimize the transportation costs of shipping one of its higher-volume products, boxes of standard copy paper. The per-unit shipping cost from each distribution center to each retail location and the amounts currently in inventory and ordered at each retail location are shown in the following table. Develop and solve an optimization model to minimize the total transportation cost and answer the following questions. Use the sensitivity report to answer parts c and d.

a. What is the minimum cost of shipping?

b. Which distribution centers will operate at capacity in this solution?

c. Suppose that 500 units of extra supply are available (and that the cost of this extra capacity is a sunk cost). To which distribution center should this extra supply be allocated, and why?

d. Suppose that the cost of shipping from Atlanta to Birmingham increased to $0.45 per unit. What would happen to the optimal solution?