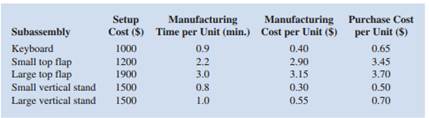

Question: Roedel Electronics produces tablet computer accessories, including integrated keyboard tablet stands that connect a keyboard to a tablet device and holds the device at a preferred angle for easy viewing and typing. Roedel produces two sizes of integrated keyboard tablet stands, a small and a large size. Each size uses the same keyboard attachment, but the stand consists of two different pieces, a top flap and a vertical stand that differ by size. Thus, a completed integrated keyboard tablet stand consists of three subassemblies that are manufactured by Roedel: a keyboard, a top flap, and a vertical stand. Roedel's sales forecast indicates that 7000 small integrated keyboard tablet stands and 5000 large integrated keyboard tablet stands will be needed to satisfy demand during the upcoming Christmas season. Because only 500 hours of in-house manufacturing time are available, Roedel is considering purchasing some, or all, of the subassemblies from outside suppliers. If Roedel manufactures a subassembly in-house, it incurs a fixed setup cost as well as a variable manufacturing cost. The following table shows the setup cost, the manufacturing time per subassembly, the manufacturing cost per subassembly, and the cost to purchase each of the subassemblies from an outside supplier:

a. Determine how many units of each subassembly Roedel should manufacture and how many units of each subassembly Roedel should purchase. What is the total manufacturing and purchase cost associated with your recommendation?

b. Suppose Roedel is considering purchasing new machinery to produce large top flaps. For the new machinery, the setup cost is $3,000; the manufacturing time is 2.5 minutes per unit, and the manufacturing cost is $2.60 per unit. Assuming that the new machinery is purchased, determine how many units of each subassembly Roedel should manufacture and how many units of each subassembly Roedel should purchase. What is the total manufacturing and purchase cost associated with your recommendation? Do you think the new machinery should be purchased? Explain.