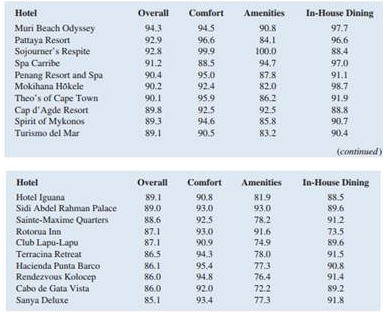

Question: Resorts & Spas, a magazine devoted to upscale vacations and accommodations, published its Reader's Choice List of the top 20 independent beachfront boutique hotels in the world. The data shown are the scores received by these hotels based on the results from Resorts & Spas' annual Readers' Choice Survey. Each score represents the percentage of respondents who rated a hotel as excellent or very good on one of three criteria (comfort, amenities, and in-house dining). An overall score was also reported and used to rank the hotels. The highest ranked hotel, the Muri Beach Odyssey, has an overall score of 94.3, the highest component of which is 97.7 for in-house dining.

a. Determine the estimated multiple linear regression equation that can be used to predict the overall score given the scores for comfort, amenities, and in-house dining.

b. Use the F test to determine the overall significance of the regression relationship. What is the conclusion at the 0.01 level of significance?

c. Use the t test to determine the significance of each independent variable. What is the conclusion for each test at the 0.01 level of significance?

d. Remove all independent variables that are not significant at the 0.01 level of significance from the estimated regression equation. What is your recommended estimated regression equation?