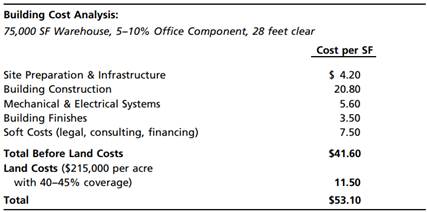

Question: (Profit Margin & Enhanced Cap Rate) Opening her morning mail, Rita the real estate analyst finds the latest Teaton-Worto research report on the Greater Northeastville industrial property market. The report indicates that overall industrial vacancy rates have dropped to about 8%, but are much lower if functionally obsolete properties are excluded from the sample. The report also reveals that net rents for high quality functional space have increased to $5 per square foot, with some deals slightly higher. Going-in cap rates for newer industrial properties are averaging about 7.5%. In light of this positive market information, Rita decides to investigate the feasibility of a new 75,000-square-foot warehouse development. She puts together the following cost estimate on a per-square-foot basis.e. How does the development phase OCC you calculated in part (c) compare to the IRR you found in part (d) of Problem? Explain how and why they differ.

Rita asks you, her new hire, to calculate the usual ratios her firm applies to development feasibility analysis (she knows they are simple somewhat ad hoc rules of thumb, but hey, they seemed to have worked well on past projects). Specifically, based on the above information determine the following:

a. The first-year return on total capital invested (or cap rate based on total development cost), equal to NOI divided by total development cost, including land. In deriving the NOI in the first year of operation, assume that building level operating expenses run about $0.90 per square foot and that the investor only pays for expenses associated with vacant space. If Rita's firm generally looks for development projects with a cap rate on cost at least 100 basis points higher than market cap rates, does this project satisfy the criteria?

b. The estimated property value and equity value at the time of completion, and then use these to compute the profit margins based on total development cost and the equity multiple assuming the land is the up-front equity investment.

Problem: Consider the development of a 100% pre-leased office building. Total development costs are estimated to be $55,000,000. The current (time 0) opportunity cost, or market value, of the land is $15,000,000 and construction cost draws are projected to be $40,000,000 in total occurring as follows: $10,000,000 at time 0, $20,000,000 one year later at the end of Year 1, and a final $10,000,000 cost at the time of project completion at the end of Year 2. The value of the completed stabilized property at the end of Year 2 (VT) is projected to be $65,000,000. T-bills are currently yielding 5.5%. The opportunity cost of capital (OCC) for construction costs contains a 50-basis-point risk premium over T-bills and is at 6%. Stabilized built property commands an investment risk premium of 300 basis points over T-bills in its going-in IRR. With this information in mind, answer the following questions related to this development project.

a. Use the OCC of the construction costs to calculate the present value of the expected construction costs as of time 0, K0, and use the OCC of stabilized built property to determine the present value of the $65 million estimated value upon completion, V0.

b. Use your calculations from part (a) to compute the time 0 NPV of the development project ignoring any up-front (time 0) costs other than the land [and the initial construction cost draw, of course, which is already accounted for in your calculation in part (a)].

c. Suppose there is $1,000,000 of additional up-front fees and costs, besides the land. Based on your answer in part (b), what is the implied maximum price the developer could pay for the land such that this development project would still be desirable at the present time?

d. Use your answer from part (c) along with the development cash flows (construction costs & stabilized value) to calculate the OCC of the development phase cash flows.

e. Assuming that $15,000,000 is the true current market value of the land (and that other upfront development fees would be no more than the $1,000,000), and assuming that the $40,000,000 cost and $65,000,000 value projections are realistic, what does your analysis in part (c) tell you about the relative ability of this developer to use this land parcel as compared to other developers?

f. If the subject developer is the first-best developer of this site, then is it possible that immediate initiation of the $40,000,000 construction project might not be optimal for this developer? Explain.