Question: Preparing a bank reconciliation and journal entries The October 31 bank statement of Wollaston's Healthcare has just arrived from State Bank. To prepare the bank reconciliation, you gather the following data:

a. The October 31 bank balance is $5,580.

b. The bank statement includes two charges for NSF checks from customers. One is for $370 (#1), and the other is for $110 (#2).

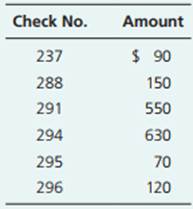

c. The following Wollaston's checks are outstanding at October 31:

d. Wollaston's collects from a few customers by EFT. The October bank statement lists a $1,500 EFT deposit for a collection on account.

e. The bank statement includes two special deposits that Wollaston's hasn't recorded yet: $850 for dividend revenue and $30 for the interest revenue Wollaston's earned on its bank balance during October.

f. The bank statement lists a $10 subtraction for the bank service charge.

g. On October 31, the Wollaston's treasurer deposited $320, but this deposit does not appear on the bank statement.

h. The bank statement includes a $500 deduction for a check drawn by Multi-State Freight Company. Wollaston's notified the bank of this bank error.

i. Wollaston's Cash account shows a balance of $2,900 on October 31.

Requirements: 1. Prepare the bank reconciliation for Wollaston's Healthcare at October 31, 2016.

2. Journalize any required entries from the bank reconciliation. Include an explanation for each entry.