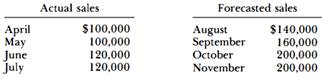

Question: Prepare a cash budget for Carly Corp. for August, September, and October, given the following information: As of July 31, the firm had a balance of $40,000 in cash, which Carly considers the minimum amount to have on hand. Fifty percent of sales are for cash, with the remaining sales collected equally in each of the following 2 months. Bad debts are negligible. Actual and projected sales are given as follows:

these costs paid during the first month after they are incurred and the remaining 10 percent paid in the second month. Capital cost allowances amount to $30,000, $32,000, and $36,000 for August, September, and October. Sales and administration expenses are $20,000 per month plus 10 percent of monthly sales. All of these expenses are paid in the month incurred. A semiannual interest payment of $ 1 8,000 on outstanding bonds (6-percent coupon) is paid during October. A $ 100,000 sinkingfund payment must also be made in October, along with payments of $20,000 in dividends and $2,000 in taxes. Finally, the firms plans to invest $80 ,000 in plant and equipment in September.

(a) Based on the above information, what is the cumulative borrowing of the firm in August, September, and October?

(b) Suppose that August receipts from sales come in uniformly during the month (assume a 30-day month), but payments for cost of goods manufactured, and sales and administrative expenses, are made on the 12th day of the month. How would this affect the cash budget for August prepared under (a)?