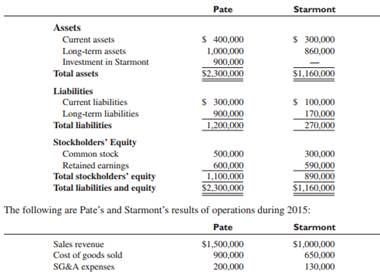

Question: On December 31, 2014, Pate Corporation acquired 80% of Starmont Corporation's common stock for $900,000 cash. Assume that the fair values of Starmont's identifiable assets and liabilities equaled book values on the acquisition date. Following are the December 31, 2014, separate balance sheets of Pate and Starmont immediately following the acquisition:

Additional Information: • Included in these totals are intra-entity sales from Pate to Starmont totaling $100,000. Pate applies the same markup on sales to Starmont as to its other customers. Starmont sold all of this inventory to outside customers during 2015 for $150,000.

• There was no goodwill impairment during 2015.

• The applicable income tax rate is 35%.

Required: 1. Prepare the December 31, 2014, consolidated balance sheet under the acquisition method.

2. Prepare the consolidated income statement for the year ended December 31, 2015. Show the deduction for net income allocated to non-controlling interest to arrive at net income- attributable to Pate shareholders.