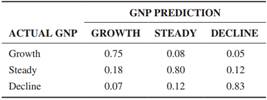

Question: Lathum Consulting is an econometrics research firm that predicts the direction of the gross national product (GNP) during the next quarter. More specifically, it forecasts whether the GNP will grow, hold steady, or decline. The following table describes Lathum's track record from past predictions by displaying the probabilities of its predictions, given the actual outcome:

For example, the chance that Lathum will predict that the GNP will grow when it actually is steady is 18%. Your company is considering a contract with Lathum Consulting to assist in predicting the direction of next quarter's GNP. Prior to enlisting Lathum's services, you have assessed the probability of the GNP growing, holding steady, and declining at 0.3, 0.45, and 0.25, respectively. Calculate the posterior probabilities, using the services of Lathum Consulting.