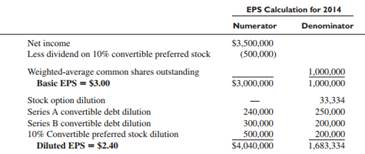

Question: Kadri Corporation reported basic EPS of $3.00 and diluted EPS of $2.40 for 2014. Its EPS calculations follow:

Kadri issued the convertible preferred stock at the beginning of 2014 and the Series A and Series B convertible debt at par in late 2013. No stock options were granted or exercised in 2014.

Required: 1. The convertible preferred stock has a $100 par value per share. How many preferred shares were issued, and what was the common stock conversion rate for each preferred share?

2. The Series B convertible debt pays interest at 10% annually, and Kadri's marginal income tax rate is 40%. How much Series B debt was outstanding, and what is the common stock conversion rate for each $1,000 face Series B bond?

3. What are the interest rate and common stock conversion rate for the $5 million par of Series A debt?

4. During the year, 50,000 shares were under option, and the average exercise price was $20 per share. What was the average market price of the company's common stock during 2014?

5. Explain why Series A debt carries a lower interest rate than Series B debt although both were issued at par on the same day in 2013.