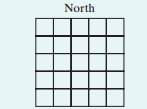

Question: In the cornfield An agriculture researcher wants to compare the yield of 5 corn varieties: A, B, C, D, and E. The field in which the experiment will be carried out increases in fertility from north to south. The researcher therefore divides the field into 25 plots of equal size, arranged in 5 east-west rows of 5 plots each, as shown in the diagram.

(a) Explain why a randomized block design would be better than a completely randomized design in this setting.

(b) Should the researcher use the rows or the columns of the field as blocks? Justify your answer.

(c) Use technology or Table D to carry out the random assignment required by your design. Explain your method clearly.