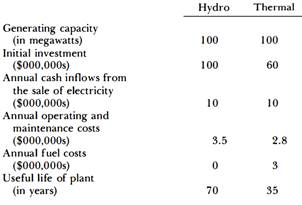

Question: In early 1 980, an electric utility that is a provincial Crown corporation and, hence, does not pay taxes, had to expand its generating capacity. The alternatives of a hydro-electric plant and a coal-fired thermal plant with the following characteristics were considered:

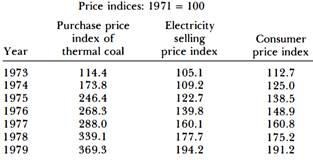

Capital budgeting proposals are evaluated net of inflation; that is, cash flows are projected based on current costs, and the discount rate applied is estimated net of inflation. There has been considerable controversy as to the proper discount rate to be applied by a Crown corporation, and estimates have ranged between 2 and 10 percent (these figures represent real discount rates net of 1 0-percent anticipated inflation). Past experience with price-level changes is summarized in the following table.

(a) Derive net present-value profiles for both projects for a range of discount rates between 0 and 10 percent. Clearly state any assumptions on which your analysis may be based.

(b) Based on the limited information provided, which alternative appears to be superior?