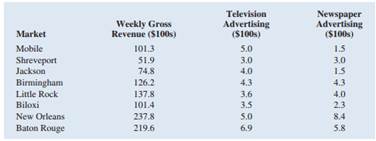

Question: Dixie Showtime Movie Theaters, Inc., owns and operates a chain of cinemas in several markets in the southern United States. The owners would like to estimate weekly gross revenue as a function of advertising expenditures. Data for a sample of eight markets for a recent week follow:

a. Develop an estimated regression equation with the amount of television advertising as the independent variable. Test for a significant relationship between television advertising and weekly gross revenue at the 0.05 level of significance. What is the interpretation of this relationship?

b. How much of the variation in the sample values of weekly gross revenue does the model in part a explain?

c. Develop an estimated regression equation with both television advertising and newspaper advertising as the independent variables. Is the overall regression statistically significant at the 0.05 level of significance? If so, then test whether each of the regression parameters b0, b1, and b2 is equal to zero at a 0.05 level of significance. What are the correct interpretations of the estimated regression parameters? Are these interpretations reasonable?

d. How much of the variation in the sample values of weekly gross revenue does the model in part c explain?

e. Given the results in parts a and c, what should your next step be? Explain.

f. What are the managerial implications of these results?