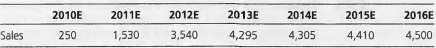

Question: Depreciation Methods, Profitability, and Valuation (Hard) A start-up firm embarks on an investment program in 2009 to manufacture and market a new switching device to be used in communications. The program requires an initial investment of $600 million in plant and equipment, increasing by $100 million each year for four years up to 2013, and then continuing at $1 ,000 million per year thereafter. The founders of the firm are keen to look profitable when they expect to take the firm public in an initial public offering (IPO) in early 2014. After awarding him stock options, they ask the newly hired chief financial officer (CFO) to prepare proforma statements of earnings and return on investment. The marketing manager supplies the CFO with the following sales forecasts (in millions of dollars), and he and the production manager estimate that operational expenses before depreciation will be 70 percent of sales.

Sales after 2016 are expected to be at the level of those in 2016. The CFO understands that with the rapid technological change that is expected, estimated useful lives of assets are quite uncertain and thinks he can justify either a three-year estimated life or a five-year estimated life for the plant and equipment. So he prepares two sets of pro formas, one depreciating the investments in plant and equipment straight-line over three years, and one depreciating them straight-line over five years.

a. Prepare the operating section of the pro forma income statements and balance sheets under both depreciation methods. Ignore tax effects.

b. Which set of pro formas shows the firm to be more profitable in 2013, just prior to the anticipated public offering? Why?

c. The CFO wishes to show the management that the depreciation method does not affect the intrinsic value of the firm at the time of the IPO. Prepare the calculations to give this demonstration, using the hurdle rate of 1 0 percent that the founders have set for investments.

d. Despite your calculation, the founders insist that the market will give a higher value if higher earnings are reported at the time of the IPO. What would be your reply to them?

e. The CFO points out that his and the founders' stock options vest in 2018, not at the time of the IPO in 2014. He therefore suggests that the focus should be on profits expected to be reported in 2018. What arguments might be made to justify using one depreciation method over the other?