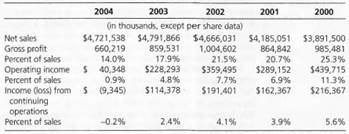

Question: Credit Scoring for a Firm with a Ratings Downgrade: Maytag Corporation (Medium) Maytag Corporation is the established manufacturer of washing machines, dryers, dishwashers, and other home appliances- including the venerable Hoover vacuum cleaner. But in 2004 and 2005, the firm faced deteriorating profitability. Competitors had moved manufacturing to low-cost countries while Maytag persisted with its high labor cost manufacturing in the United States. The following shows how Maytag's sales stalled over the period 2000- 2004, with a negative effect on income.

In April 2005, the firm's bonds were downgraded to junk status by all three major bond rating agencies. Maytag's financial statements for 2004 are on the Web page for Chapter 16. If you worked Minicase Ml6.3, you will have reformulated these statements.

a. What aspects of the financial statements tell you about the declining credit quality from 2003 to 2004?

b. What scores might you develop from these statements that would indicate the declining credit quality?