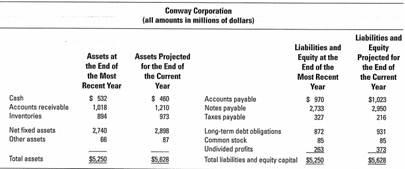

Question: Conway Corporation has placed a term loan request with its lender and submitted the following balance sheet entries for the year just concluded and the pro forma balance sheet expected by the end of the current year. Construct a pro forma Statement of Cash Flows for the current year using the consecutive balance sheets and some additional needed information. The forecast net income for the current year is $217 million with $65 million being paid out in dividends. The depreciation expense for the year will be $100 million and planned expansions will require the acquisition of $300 mil-lion in fixed assets at the end of the current year. As you examine the pro forma Statement of Cash Flows, do you detect any changes that might be of concern either to the lender's credit analyst, loan officer, or both?