Question: Continental Trucking Norm Painter is the newly hired cost analyst for Continental Trucking. Continental is a nationwide trucking firm, and until recently, most of its routes were driven under regulated rates. These rates were set to allow small trucking firms to earn an adequate profit, leaving little incentive to work to reduce costs by efficient management techniques. In fact, the greatest effort was made to try to influence regulatory agencies to grant rate increases. A recent rash of deregulation has made the long-distance trucking industry more competitive. Norm has been hired to analyze Continental's whole expense structure. As part of this study, Norm is looking at truck repair costs. Because the trucks are involved in long hauls, they inevitably break down. In the past, little preventive maintenance was done, and if a truck broke down in the middle of a haul, either a replacement tractor was sent or an independent contractor finished the haul. The truck was then repaired at the nearest local shop.

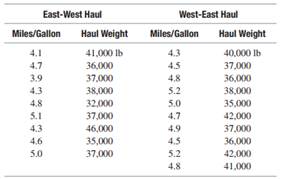

Norm is sure this procedure has led to more expense than if major repairs had been made before the trucks failed. Norm thinks that some method should be found for determining when preventive maintenance is needed. He believes that fuel consumption is a good indicator of possible breakdowns; as trucks begin to run badly, they will consume more fuel. Unfortunately, the major determinants of fuel consumption are the weight of atruck and headwinds. Norm picks a sample of a single truck model and gathers data relating fuel consumption to truck weight. All trucks in the sample are in good condition. He separates the data by direction of the haul, realizing that winds tend to blow predominantly out of the west. Although he can rapidly gather future data on fuel consumption and haul weight, now that Norm has these data, he is not quite sure what to do with them.