Question: Classify each of the following as nominal, ordinal, interval, or ratio data.

a. The ranking of a company by Fortune 500

b. The number of tickets sold at a movie theater on any given night

c. The identification number on a questionnaire

d. Per capita income

e. The trade balance in dollars

f. Profit/loss in dollars

g. A company's tax identification

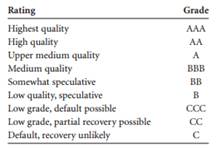

h. The Standard & Poor's bond ratings of cities based on the following scales: