Question: Canadian Industries sells a single product. In both November and December (the last 2 months), it sold 25,000 units at $4 each. Sales for January to April are projected as follows:

January 25,000 units

February 30,000 units

March 37,500 units

April 41,250 units

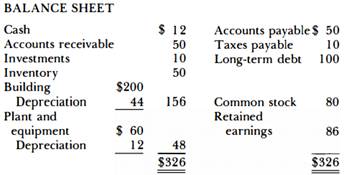

Subsequently, monthly sales are expected to remain stable at April's level. Half of all sales are on credit at terms of 2 / JO, net 30. Cash sales comprise the other half and also receive the 2-percent discount. Thirty percent of credit customers pay within the discount period. Typically, 80 percent of all credit sales made in any one month are outstanding at the end of that month, and 20 percent will be outstanding at the end of the following month. Bad debts are negligible. Inventory is purchased one month in advance of anticipated sales at a cost of $2 per unit. Payments are made to suppliers when the goods are sold. Salaries (20 percent of sales), other variable costs ( 10 percent of sales), and fixed costs of $ 1 5,000 (excluding depreciation) are paid each month. The firm's tax rate is 50 percent. Dividends of $5,000 are paid each quarter starting in March. Taxes are paid in April. Interest on long-term debt is at nominal annual rate of 12 percent and is payable quarterly, with the next payment due in March. Depreciation on the building is taken on a straight-line basis over 20 years, assuming a salvage value of $80,000. Plant and equipment is also depreciated on a straight-line basis, but over 10 years with no salvage value assumed. The balance sheet as at December 31, 1 987 is presented below (in 000s).

Prepare a monthly cash budget from January to April, a pro Jonna income statement for the same period, and a pro forma balance sheet as at April 30, 1 988.