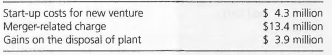

Question: Calculating Core Profit Margin (Easy) A firm reports operating income before tax in its income statement of $73.4 million on sales of$667.3 million. After net interest expense of$20.5 million and taxes of$18.3 million, its net income is $34.6 million. The following items are included as part of operating mcome:

The firm also reports a currency translation gain of $8.9 million as part of other comprehensive income. Calculate the firms core operating income (after tax) and core percentage profit margin. The firms marginal tax rate is 39 percent.