Question: Boeing Going Strong

Wide Range of Products: The United States government spends billions of dollars for defense every year; in 2005 alone, that amount exceeded $500 billion. One of the companies the government has turned to for its defense needs is aircraft manufacturer Boeing. Employees at Boeing have built helicopters and passenger planes, fighter planes and missiles, satellites and spacecraft. They have sent astronauts to the moon and brought countries together aboard the International Space Station.

Boeing's Defense Link: William Boeing, founder and owner, started the company in 1916 with the incorporation of the Pacific Aero Products Company. That same year, Boeing produced its first airplane, the B&W

Seaplane. Just a year later the company began its relationship with the government through test flights for the U.S. Navy. The Navy responded by ordering 50 seaplane trainers for a total of $116,000. Almost 90 years later in 2003, the Navy purchased 210 Super Hornets for a staggering $8.6 billion.

Ahead of the Pack

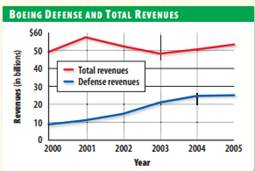

Over time, Boeing has become the world's leading aerospace producer and the largest manufacturer of commercial jetliners and military aircrafts combined. From its small beginnings, the company now has customers in nearly 150 countries, with 150,000 workers in 48 states and 67 countries. While Boeing sells its products to both governments and private customers, defense revenues make up more than half of total revenues-and help Boeing to be the secondlargest defense company in the United States.

Analyzing the Impact Question

1. Summarizing Why is defense spending important to Boeing?

2. Drawing Conclusions What world events may have contributed to the increase in defense revenues from 2000 to 2005?