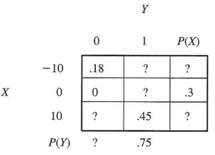

Question: As you walk into your econometrics exam, a friend bets you SIO that she will outscore you on the exam. Let X be a random variable denoting your winnings. X can take on the values 10, -10, or 0 (you tie on the exam). You know that the distribution function for X, 12(X) depends on whether she studied for the exam or not. Let Y= 0 if she studied and Y= 1 if she did not. Consider the following joint distribution table:

a. Fill in the missing elements in the table.

b. Compute E[X] and E[Y]. Should you take the bet? Why?