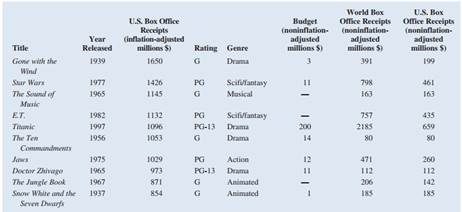

Question: All-Time Movie Box Office Data The motion picture industry is an extremely competitive business. Dozens of movie studios produce hundreds of movies each year, many of which cost hundreds of millions of dollars to produce and distribute. Some of these movies will go on to earn hundreds of millions of dollars in box office revenues, while others will earn much less than their production cost. Data from fifty of the top box office receipt generating movies are provided in the file top50Movies. The following table shows the first ten movies contained in this data set. The categorical variables included in the data set for each movie are the rating and genre. Quantitative variables for the movie's release year, inflation- and noninflation-adjusted box office receipts in the United States, budget, and the world box office receipts are also included.

Managerial Report: Use the data visualization methods presented in this chapter to explore these data and discover relationships between the variables. Include the following, in your report:

1. Create a scatter chart to examine the relationship between the year released and the inflation-adjusted U.S. box office receipts. Include a trendline for this scatter chart. What does the scatter chart indicate about inflation-adjusted U.S. box office receipts over time for these top 50 movies?

2. Create a scatter chart to examine the relationship between the budget and the noninflation-adjusted world box office receipts. (note: You may have to adjust the data in Excel to ignore the missing budget data values to create your scatter chart. You can do this by first sorting the data using Budget and then creating a scatter chart using only the movies that include data for Budget.) What does this scatter chart indicate about the relationship between the movie's budget and the world box office receipts?

3. Create a frequency distribution, percent frequency distribution, and histogram for inflation-adjusted U.S. box office receipts. Use bin sizes of $100 million. Interpret the results. Do any data points appear to be outliers in this distribution?

4. Create a PivotTable for these data. Use the PivotTable to generate a crosstabulation for movie genre and rating. Determine which combinations of genre and rating are most represented in the top 50 movie data. Now filter the data to consider only movies released in 1980 or later. What combinations of genre and rating are most represented for movies after 1980? What does this indicate about how the preferences of moviegoers may have changed over time?

5. Use the PivotTable to display the average inflation-adjusted U.S. box office receipts for each genre-rating pair for all movies in the dataset. Interpret the results.