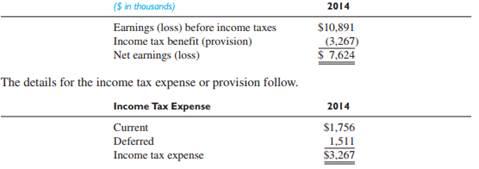

Question: ABC Inc. is in the business of airframe maintenance, modification and retrofit services, avionics and aircraft interior installations, the overhaul and repair of aircraft engines, and other related services. The following are excerpted from its income statement for the year ended December 31, 2014.

Because a goodwill impairment charge taken under GAAP may not be deducted for tax purposes, the company's tax expense was higher by $1,076 than would be expected based on the

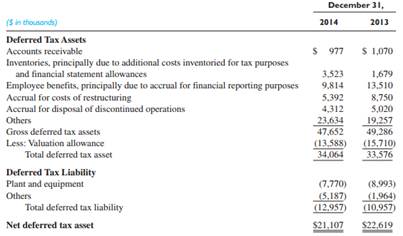

statutory tax rate of 35%. State taxes added another $927 to the tax expense. However, the reduction in the valuation allowance decreased the accounting income tax expense. In addition, several other items caused the tax expense to deviate from the tax liability. Because these items by themselves are immaterial, no separate breakdowns are available. The following breakdowns are available for the balance sheet values of deferred tax assets and liabilities:

The book value of the company's inventories increased from $91,130 at the end of 2013 to $127,777 at the end of 2014.

Required: 1. Prepare a schedule reconciling the statutory and effective tax rates of ABC Inc. for the year ended 2014.

2. Provide the journal entry to record the income tax expense for 2014, showing separately the effects on deferred tax asset, valuation allowance, and deferred tax liability.

3. For each component of deferred tax asset/liability, provide possible reasons for the change in its value from 2013 to 2014.