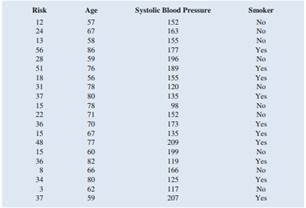

Question: A recent ten-year study conducted by a research team at the Great Falls Medical School was conducted to assess how age, systolic blood pressure, and smoking relate to the risk of strokes. Assume that the following data are from a portion of this study. Risk is interpreted as the probability (times 100) that the patient will have a stroke over the next ten-year period. For the smoking variable, define a dummy variable with 1 indicating a smoker and 0 indicating a nonsmoker.

a. Develop an estimated multiple regression equation that relates risk of a stroke to the person's age, systolic blood pressure, and whether the person is a smoker.

b. Is smoking a significant factor in the risk of a stroke? Explain. Use a 0.05 level of significance.

c. What is the probability of a stroke over the next ten years for Art Speen, a 68-yearold smoker who has systolic blood pressure of 175? What action might the physician recommend for this patient?

d. Can you think of any other factors that could be included in the model as independent variables?