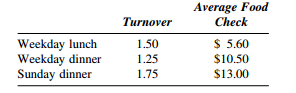

Question: A financial feasibility study is being carried out for a proposed new 120- seat restaurant. It will be open for both lunch and dinner from Monday through Saturday and for dinner only on Sunday. For the sake of simplicity, assume a 52-week year. Seat turnover and average food check figures are estimated as follows:

In addition, the restaurant has a small banquet room, and food sales revenue in this area is estimated at $14,000 a month. Alcoholic beverage revenue is estimated to be 12% of lunch food sales revenue and 30% of all food sales revenue. In the banquet room, alcoholic beverage revenue is forecast to be 40% of food sales revenue in that area. Food cost is estimated at 40% of total food sales revenue, and beverage cost is 28% of total beverage sales revenue. Wage cost for salaried personnel (manager, chef, hostess, head server, and cashier) is estimated at $300,000 per year. Wages for all other employees will be 15% of total annual restaurant sales revenue. Employee benefits (vacations, meals, etc.) are estimated to be 10% of total annual wages. Other operating costs are estimated at 12% of total annual wages and salaries. Undistributed costs are forecast to be $130,000 per year. Prepare the restaurant's pro forma income statement for the first year. Ignore income tax.