QUESTION 1

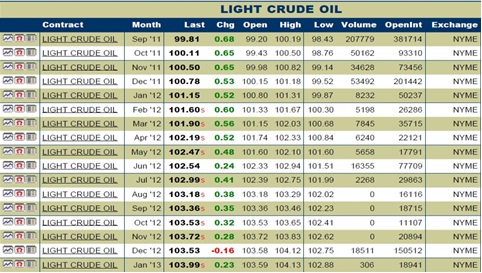

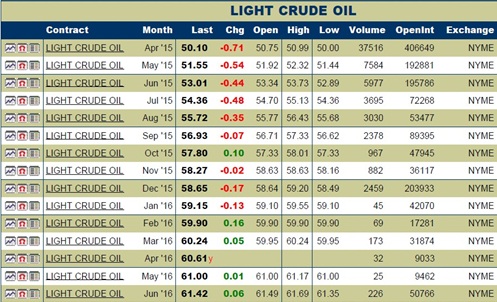

I) Crude oil futures prices traded on the NYMEX are presented at the tables below.

Table 1: Crude Oil Futures Prices on 22 July 2011

Table 2: Crude Oil Futures Prices on 4 July 2013

Table 3: Crude Oil Futures Prices on 23 February 2015

(a) Plot the crude oil forward curve on 22 July 2011, 4 July 2013 and 23 February 2015. Discuss the key differences of the forward curves over these three dates and provide possible explanations of the observed patterns with regards to the market conditions at the time.

(b) On 4 July 2013, the spot crude oil price was USD101.20 per barrel, the monthly storage (freight) cost for crude oil was estimated at 29 cents per barrel payable in advance and the interest rate was 4.3% per annum with continuous compounding. Calculate the convenience yields of the crude oil on 4 July 2013 for three-month contracts (Sept 2013) and for six-month contracts (Dec 2013) by using information from Table 2. Explain what these convenience yields imply.

II) It is now 20 April 2017, and an airline company is expected to purchase 15 million gallons of jet fuel in three months. The current jet fuel price is USD 1.56 per gallon and the airline company decides to use heating oil futures contracts trading in NYME to control price risk. The five-month heating oil futures price is USD 1.6737. The (three-month) standard deviation of the jet fuel price changes is 0.0368, the (three-month) standard deviation of the heating oil futures price changes is 0.0415, and the correlation coefficient between these price changes is 0.872.

(a) Calculate the optimal number of contracts required (by tailing the hedge) and recommend an effective hedge.

(b) Assume that the airline is ready to purchase 15 million gallons of jet fuel on 20 of July 2017. The jet fuel price has increased to USD 1.893 per gallon and the heating oil futures price for delivery in two months is US 2.0125 per gallon. Calculate the outcome with and without the hedge. What is the effective selling price with and without the hedge?

(c) Explain how the hedge would have worked if the jet fuel price had decreased to USD 1.350 and the heating oil futures price for delivery in two months was USD 1.514 per gallon.

(d) Discuss briefly why Singapore airlines and Cathay have suffered significant losses as a result of hedging costs in 2015 and 2016 (in relation to the above application).

Heating Oil Futures Contract Specifications (CME)

Trading Unit: 42,000 U.S. gallons (1,000 barrels).

Price Quotation: In dollars and cents per gallon

Trading Months: Trading is conducted in 18 consecutive months commencing with the next calendar month (for example, on January 2, 2002, trading occurs in all months from February 2002 through July 2003).

Last Trading Day Trading terminates at the close of business on the last business day of the month preceding the delivery month.

Delivery: Heating Oil is F.O.B. seller's facility in New York Harbor, ex-shore. All duties, entitlements, taxes, fees, and other charges paid. Requirements for seller's shore facility: capability to deliver into barges. Buyer may request delivery by truck, if available at the seller's facility, and pays a surcharge for truck delivery.

Delivery may also be completed by pipeline, tanker, book transfer, or inter- or intra-facility transfer. Delivery must be made in accordance with applicable federal, state, and local licensing and tax laws.

QUESTION 2

Today is April 1, 2017. The current level of the S&P 500 index is 2342.28, the dividend yield on the index is expected to be 2.9% per annum with continuous compounding and the risk-free rate is 3.5% per annum with continuous compounding. You are an equity derivatives trader and you have been dealing with two clients who each own a $50 million all-equity portfolio with beta of 1.20. Client A wants to eliminate all the exposure to market movements, over the next four months. Client B is an assertive investor who believes that stock markets will improve in the near future thus he is interested to increase the beta of his position to 2.20 over the next four months. Both clients decide to use September 2017 CME S&P 500 futures contracts. The S&P 500 futures contract is worth $250 times the index. Assume that the dividend yield on the index and the risk- free rate when expressed as simple rates are approximately the same as the continuously compounded rates.

(a) What is the theoretical futures price for the September 2017 index futures contract (six- month contract)?

(b) What trade should you order for client A?

(c) What trade should you order for client B?

(d) Assume that on August 2, 2017, the level of the index is 2,000, the dividend yield on the index is 2.5% per annum with continuous compounding and the risk-free rate is 3.10% per annum with continuous compounding. Both clients decide to close out their positions in the futures contracts. Calculate the expected value of the position and the expected return of the strategy followed by

(i) client A

(ii) client B

(e) Assume that on August 2, 2017, the level of the index is 2,700, the dividend yield on the index is 2.9% per annum with continuous compounding and the risk-free rate is 3.97% per annum with continuous compounding. Both clients decide to close out their positions in the futures contracts. Calculate the expected value of the position and the expected return of the strategy followed by

(i) client A

(ii) client B

(f) Give three reasons that explain why client A cannot achieve a perfect hedge.

(g) Use the analysis in parts (d) and (e) to provide a brief recommendation to your clients (maximum 400 words).

Question 3

The ten-month futures price of the S&P500 index is currently 2340.10, the S&P500 index is 2347.80, the volatility of the index futures price is 18% per annum, the dividend yield of the index is 3.4% per annum and the risk-free interest rate is 2.8% per annum both with continuous compounding. Estimate the price of a nine-month European CALL option on index futures with a strike of 2340 by using

(a) one-step binomial tree,

(b) three-step binomial tree,

(c) six-step binomial tree, (d)the Black's formula.

(e) Compare and comment on the option prices obtained in parts (1a)-(1d).

(f) Use Excel's GoalSeek Tool function to estimate the implied volatilities of the index futures price, based on the market prices of the nine-month European call options on index futures provided in the following table.

|

|

K=2320

|

K=2330

|

K=2340

|

K=2350

|

K=2360

|

K=2370

|

K=2380

|

|

Option price

|

151.81

|

145.95

|

140.12

|

134.70

|

130.26

|

126.16

|

122.80

|

|

Implied volatility

|

|

|

|

|

|

|

|

I. Complete the table above with the estimated implied volatilities (correct to 3 decimal places).

II. Plot the implied volatility as a function of the strike price.

III. Are these option prices consistent with the assumptions underlying the Black-Scholes model? Does the implied volatility depend on the moneyness of the option? Explain.

(g) Explain how implied volatility differs from the historical volatility.

Question 4

On February 21st, 2017, your friend placed the following order on an online trading provider:

Short 10 European call currency option contracts on Australian dollars with maturity August 2017 and strike 0.8000

Short 20 European put currency options contracts on Australian dollars with maturity August 2017 and strike 0.7500. Each contract has a size of 10,000 Australian dollars.

On February 21st, 2017, the spot exchange rate was quoted at 0.7715 USD per Australian dollar, the US interest rate was 2.02% p.a. and the Australian interest rate was 2.88% p.a. with continuous compounding. The exchange rate volatility was 23% p.a..

a) Use the Black Scholes's model to estimate the premium involved to trade these options. Did he pay or receive this premium?

b) Indentify the strategy that your friend used and provide the table and the diagram of the expected profit/loss generated by the strategy.

c) Discuss the profit and loss potential associated with this strategy. What was your friend's expectation on market volatility and direction (bull or bear) when he placed the order?

d) Calculate the losses your friend would be making if he exercises in August 2017 when the spot exchange rate is 0.9250.

Attachment:- CASE-STUDY.rar