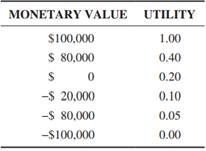

Question: 1. Replace all monetary values in Problem 44 with the following utilities:

(a) What do you recommend, based on expected utility?

(b) Is the investor a risk seeker or a risk avoider? Justify your answer.

2. The Jamis Corporation is involved with waste management. During the past 10 years it has become one of the largest waste disposal companies in the Midwest, serving primarily Wisconsin, Illinois, and Michigan. Bob Jamis, president of the company, is considering the possibility of establishing a waste treatment plant in northern Mississippi. From past experience, Bob believes that a small plant would yield a $500,000 profit, regardless of the demand for the plant. The success of a medium-sized plant would depend on demand. With a low demand for waste treatment, Bob expects a $200,000 profit. A fair demand would yield a $700,000 profit, and a high demand would return $800,000. Although a large plant is much riskier than a medium-sized one, the potential rewards are much greater. With a high demand, a large plant would return $1,000,000. However, the plant would yield a profit of only $400,000 with a fair demand, and it would actually lose $200,000 with a low demand. Looking at the current economic conditions in northern Mississippi, Bob estimates that the probabilities of low, fair, and high demands are 0.15, 0.4, and 0.45, respectively.

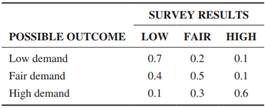

Because of the large potential investment and the possibility of a loss, Bob has decided to hire a market research team that is based in Jackson, Mississippi. This team will perform a survey to get a better feel for the probability of a low, medium, or high demand for a waste treatment facility. The cost of the survey is $50,000, and the survey could result in three possible outcomes-low, fair, and high. To help Bob determine whether to go ahead with the survey, the marketing research firm has provided Bob with the following information regarding the conditional probabilities, i.e., P1Survey results Possible outcomes2:

For example, P1Low survey result Low demand2= 0.7. What should Bob do?