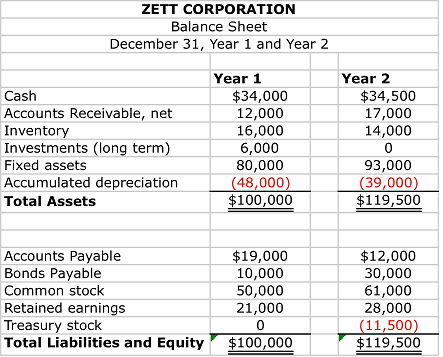

A colleague who is aware of your understanding of financial statements asks for help in analyzing the transactions and events of Zett Corporation. The following date are provided:

Additional data for the period January 1, Year 2, through December 31, Year 2, are:

1. Sales on account, $70,000.

2. Purchases on account, $40,000.

3. Depreciation, $50,000.

4. Expenses paid in cash, $18,000 (including $4,000 of interest and $6,00 in taxes).

5. Decrease in inventory, $2,000

6. Sales on fixed assets for $6,000 cash; cost $21,000 and two-thirds depreciated (loss or gain is included in income).

7. Purchase of fixed assets for cash, $4,000.

8. Fixed assets are exchanged for bonds payable of $30,000.

9. Sale of investments for $9,000 cash.

10. Purchase of treasury stock for cash, $11,500.

11. Retire bonds payable by issuing common stock, $10,000.

12. Collections on accounts receivable, $65,000.

13. Sold unissued common stock for cash, $1,000.

Required

a. Prepare a statement of cash flows (indirect method) for the year ended December 31, Year 2.

b. Prepare a side-by-side comparative statement contrasting two bases of reporting: (1) net income and (2) cash flows from operations.

c. Which of the two financial reports in (b) better reflects profitability? Explain.