problem 1: Wan Group plans to incorporate a company to be known as Wan Group Ltd for the distribution of locally made automotive spare parts. They intend to contribute an initial capital of Sh.45,000 in cash. After approaching his bank manager for financial support, they were asked to submit projected statements of the profits and cash flows of the business for the next four months commencing 1 July 2008. After careful analysis, Wan Group gathered the following information relating to the business operations for the six months to December 31,2008:

A) At the begging of July operating furniture and equipment will be acquired for cash at a total cost of sh.88,000. In addition, stocks costing Sh.50,000 will be acquired out of which half will be paid for in cash and the balance in the following month.

B) Stock levels will be maintained at a level that is sufficient to satisfy sales for the next month. The company intends to earn a gross margin of 50% on sales. Credit terms from suppliers require payment after one month form the date of purchase.

C) Sales are expected to average Sh.60,000 per month for the next one year. It is expected that 75 per cent of customers will pay in cash and 25 per cent will take credit. All credit sales are due within 30 days.

D) The following monthly expenses will be incurred:

Rent – Sh.10,000; Salaries – Shs.6,000; Miscellaneous expenses – Sh.2,500; Depreciation – Sh.3,000.

All expenses will be paid for in the month in which they are incurred, except for rent, which is payable quarterly in advance.

E) The proprietor expects to withdraw Shs.5,000 from the business every month for personal use.

Required:

Prepare a cash budget for each of the months of July, August, September and October 2008 for Wan Group Ltd. The budget should be columnar form and all supporting workings should be shown.

problem 2:

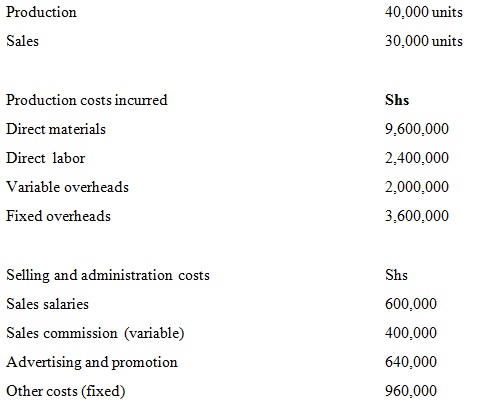

Onatracom Company, a manufacturer of retread tyres has provided the following information about operations during the financial year ended 30 September 2010.

The unit selling price for the company’s product is shs.600.

Required:

a) Draft the profit and loss statements of Onatracom Company using both marginal costing and absorption costing approaches.

b) describe the difference in profits under the two methods.