Please include the following problems to be submitted as your homework handout 5 due at the beginning of class on the due date assigned in Canvas and the course schedule. Please show all work and computations in your HW, quizzes, tests and final for full credit.

Homework

1. What is a person's gross income and how is it calculated?

2. What is a person's adjusted gross income? List 4 adjustments that can be deducted from your

gross income.

3. What is the difference between deductions and exemptions? List 5 deductions or exemptions that a person may claim on their taxes.

4. What is a peon's taxable income?

5. Suppose you earned wages $47200, received $2400 in interest from savings account, and contributed $3500 to a tax deferred retirement account. You are entitled to a personal exemption of $3300 and deductions totaling $5150.

a. What is your gross income?

b. What is your adjusted gross income?

c. What is your taxable income?

6. Suppose you earned wages $88750, received $4900 in interest from savings account, and contributed $6200 to a tax deferred retirement account. You are entitled to a personal exemption of $3300 and deductions totaling $9050.

a. What is your gross income?

b. What is your adjusted gross income?

c. What is your taxable income?

7. Suppose you have expenditures $8600 for interest on your mortgage, $2700 for charitable contributions, and $645 for state income taxes. If your filing status entitles you to a $10300 standard deduction, should you take the standard deduction or itemize your deductions? Explain your reasoning.

8. Suppose you have expenditures of $3700 for charitable contributions and $760 for state income taxes. If your filing status entitles you to a $5150 standard deduction, should you take the standard deduction or itemize your deductions? Explain your reasoning.

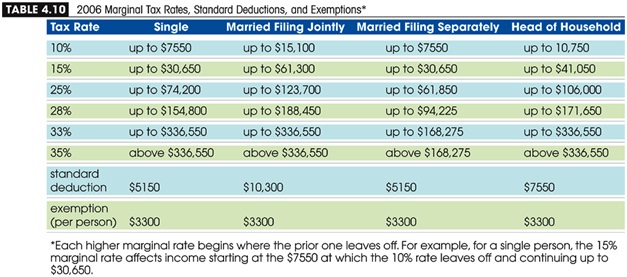

Use the 2006 Marginal Tax Table to answer questions 9-14.

9. Suppose you are single and earned wages of $33200. You received $350 in interest from a savings account. You contribute $500 to a tax deferred retirement fund. You have $450 in deductions from charitable contributions and take the standard deduction.

a. How much is your exemption?

b. How much is your standard deduction?

c. What is your gross income?

d. What is your adjusted gross income?

e. What is your taxable income?

f. How much are your income taxes owed?

10. Suppose you are married but you and your spouse files separately. If your salary is $45400. You received $500 in interest from a savings account. You have $1500 in itemized deductions from charitable contributions and claim 3 exemptions (for you and 2 children).

a. How much is your exemption?

b. How much is your standard deduction?

c. What is your gross income?

d. What is your adjusted gross income?

e. What is your taxable income?

f. How much are your income taxes owed?

11. Suppose you are single and have a taxable income of $35,400.

a. How much are your income taxes?

b. How much are your FICA taxes (assume you work for a company that pays half).

c. How much are your total taxes?

d. What is your overall tax rate?

12. Suppose you are head of household and have a taxable income of $89,300. You are entitled to a

$1000 tax credit.

a. How much are your income taxes (after your tax credit)?

b. How much are your FICA taxes (assume you work for a company that pays half).

c. How much are your total taxes?

d. What is your overall tax rate?

13. Suppose you are married filing separately with a taxable income of $127300.

a. How much are your income taxes?

b. How much are your FICA taxes (assume you are self-employed with no adjustments to gross income).

c. How much are your total taxes?

d. What is your overall tax rate?

14. Suppose you are in the 28% tax bracket. How much will your tax bill be reduced if you qualify for a $500 tax credit?

15. Suppose you are in the 33% tax bracket. How much will your tax bill be reduced if you make a

$1200 contribution to charity?

16. Define: receipts, outlays, net income, deficit, surplus.

17. What is the difference between "deficit" and "debt".

18. Suppose your gross income was $44580 last year. If you spent 26480 in rent and food, 3200 in interest on credit card and loans, 8450 in car expenses and 14800 in taxes.

a. Do you have a deficit or surplus?

b. How much is the deficit or surplus?

c. Suppose you receive a 6% raise next year, how much additional income do you expect next year?

d. How much will your debt be at the end of next year?

19. What is an index number?

20. What is the Consumer Price Index Number?

21. Suppose the current cost of $2.10. If gas prices were $3.25 in April 2015 (use this as a reference price).

a. Find the index number.

b. What does this index number mean?

c. If the cost to fill your car was $42.50 last year, what would it cost today?

d. If it cost $22.45 to fill your car today, what did it cost last year?

22. What is Inflation?

23. What is Deflation?

24. Find the inflation rate from 1973 to 2005 using the table of average annual consumer price index.

25. Find the inflation rate from 1995 to 2000 using the table of average annual consumer price index.

26. Find the inflation rate from 1980 to 1984 using the table of average annual consumer price index.

|

Average Annual Consumer Price Index (1982-1984 = 100)

|

|

Year

|

CPI

|

Year

|

103.9

|

Year

|

CPI

|

|

1973

|

44.4

|

1984

|

103.9

|

1995

|

152.4

|

|

1974

|

49.3

|

1985

|

107.6

|

1996

|

156.9

|

|

1975

|

53.8

|

1986

|

109.6

|

1997

|

160.5

|

|

1976

|

56.9

|

1987

|

113.6

|

1998

|

163.0

|

|

1977

|

60.6

|

1988

|

118.3

|

1999

|

166.6

|

|

1978

|

65.2

|

1989

|

124.0

|

2000

|

172.2

|

|

1979

|

72.6

|

1990

|

130.7

|

2001

|

177.1

|

|

1980

|

82.4

|

1991

|

136.2

|

2002

|

189.9

|

|

1981

|

90.9

|

1992

|

140.3

|

2003

|

184.0

|

|

1982

|

96.5

|

1993

|

144.5

|

2004

|

188.9

|

|

1983

|

99.6

|

1994

|

148.2

|

2005

|

195.3

|