One way to think about wages for different jobs is to see it as another application of the law of one price. We came across this law when we discussed speculation in Chapter 7, and it came up again when we discussed international trade in Chapter 9. The basic idea is that the supply of workers will keep adjusting until jobs that need the same kinds of workers earn the same wage.

If similar workers earned different wages, then the workers in the low-paid jobs would reduce their labor supply, and the workers in the high-paid jobs would face more competition from those low-paid workers. Let's look at 100 computer programmers who are trying to decide whether to work for one of two companies:

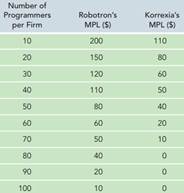

Robotron or Korrexia. To keep things simple, assume that both companies are equally fun to work for, so you don't need to worry about compensating differentials here. The marginal product of labor (per additional hour of work) is in the following table:

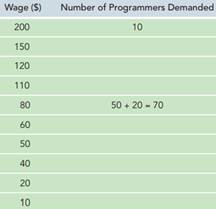

a. These two firms are the whole market for programmer labor. In the next table, estimate the programmer demand curve by adding up the quantity of programmers demanded at each wage. For example, at a wage of $80 per hour, Robotron would hire 50 workers (since the first 50 workers have a MPL ≥ 80) and Korrexia 20, so the total demand is 70 workers.

b. The programmers in this town are going to work at one of these two places for sure: Their labor supply is vertical, or in other words, perfectly inelastic, with supply = 100. So, what will the equilibrium wage be? Just as in Figure 18.1, the numbers may not work out exactly-so use your judgment to come up with a good answer.

c. Now, head back to the first table: About how many programmers will work at Robotron and how many at Korrexia? Again, use your judgment to come up with a good answer.

d. Suppose 50 more programmers come to town. What will the wage be now? And how many will work at each firm?