Question 1: Capital Budgeting

Involves a case study. Although the case and company are fictional, parts of the case are based on actual, albeit simplified, data and situations.

In Novation Ltd is a listed company that provides software and related products and services. Management of the company has approached you (a clever consultant) to provide advice on a number of long-term project proposals.

In a meeting with management you are told that the company has no systematic approach to capital budgeting and has never estimated the company's weighted cost of capital. (‘How did this company get listed?' you wonder!) The CEO said that the company's share price has been increasing and they want to see this continue.

The Projects

The CEO tells you several projects have been suggested for the coming year. It is these projects on which they seek your advice. Relevant after tax net cash flows have been estimated for Projects A to D but not for Project E.

Proposals for projects A and B have emanated from the app development and servicing division of the company. This division currently has spare technical capacity but only enough for one project. Proposals for projects C and D have come from the FinQuery division. Project E represents a potential new area of business for the company.

Project A

This project involves developing an app (and supporting services) for DIY (Do-It-Yourself) renovators that will provide instant advice via short videos, networking with other DIY's in the local area and, with a premium membership charge, the ability to instant message or VOIP with a certified building or interior decorator adviser. [If one of you clever students ever develops one of these please let me know, I need this service and will buy shares in the business - if the valuation stacks up ;)]. Revenues would be generated from membership fees (customers can join at their preferred membership level after a limited one week trial period). At the end of the project's three year life, significant changes in technology are expected and the app would need upgrading completely, thus would become a new investment decision at that time. The project would cost $7.5 million to set up and is then expected to net $1.5 million in cash flows in the first year, $3 million in the second year and $10 million in the third year. If this project goes ahead the app development and servicing division's technical capacity will be used up and current conditions preclude adding more capacity.

Project B

This project proposal also comes from the app development and servicing division. The project involves developing an app similar to Project A but on DIY investing. The market for this type of site is quite developed and so customer numbers are expected to reach a maximum quickly as market share is achieved. For this reason, revenues are expected to remain constant over the three year life of the project. The project would cost $7.5 million to set up. Net cash flows are expected to be $4.3 million per year during the project's three year life. The project needs the same technical capacity as

Project A.

Project C

One of the core divisions which the company operates is responsible for maintaining a large, cloud-based financial analytics software program and database called FinQuery, marketed under license by an unrelated company. This area of the business is expected to continue generating its stable income for the foreseeable future. The company currently operates data storage servers for this business but they are not expected to provide sufficient capacity in the future. Therefore, the division's technicians have identified two new potential data storage servers. One of these servers is moderately priced, very energy efficient and has an expected life of 5 years. It will cost $490,000 and an extra $10,000 will need to be spent to ship and install it. It is expected to produce net cash flows of $225,000 each year of its life. The technicians anticipate that at the end of its life it will be replaced by a similar server that is likely to have the same cost, life and cash flows.

Project D

This project is the second data storage server alternative mentioned in Project C above. It costs the same as the first and will require the same costs in shipping and installation. However, it is not as efficient and so is expected to provide net cash flows of only $150,000 a year but over its longer 10-year life.

Project E

This project involves producing household 3D printers and associated software. Although In Novation has had global reach through its apps and software programs, it has never produced hardware before. But management is very excited about this new technology and believes it is the future of production (and the CEO is a huge Star Trek fan so of course wants to develop a food replicator one day - but to request ‘Coffee, Mandheling, strong' not ‘Tea, Earl Grey, hot'). Market research has been undertaken by the firm's marketing department (which they say cost $100,000) and their conclusions are that demand (at current prices) is small, which means that significant marketing would be needed. Market conditions are expected to be such that the project ends after 5 years, when technological developments and competition will call for significantly different kinds of 3D printers. However, the marketing manager thinks that the publicity the company will receive for entering this cutting edge market will bring benefits to the company's other products and services to the tune of around $1 million annually before tax during Project E's life.

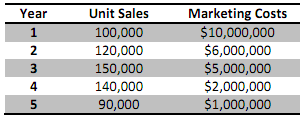

The marketing department has estimated unit sales and marketing costs for each year as shown in the table below. Sales price is expected to be $1,600 per unit (i.e. per printer) in the first two years but after that the price is expected to fall by 5% per year due to increasing competition and technological developments.

The printers will be sold to electronics retailing companies, which will require In Novation to pay the costs of shipping to their distribution centres. This cost is estimated to be $100 per unit in the first year and will increase in line with inflation. Inflation is expected to be 4% per year.

The company currently has some vacant factory space that would be suitable for the project. The intention was to put this space on the rental market for $2 million per year but the CEO has agreed to the space being used for Project E if the project proposal is accepted.

A consultant was commissioned at a cost of $120,000 to undertake a technical feasibility analysis of the project and give advice on the potential equipment and production costs. This analysis indicated that new high tech production equipment would be needed for the project at a cost of $70 million.

Installation of the equipment would cost $400,000. The equipment can be depreciated to zero for tax purposes using prime cost over its five year life. The equipment would be sold to a metal scrap yard for $350,000 at the end of this time.

The consultant also estimated that raw materials, labour and other variable production and packaging costs per unit would be $900 in the first year and increase in line with inflation (as noted earlier, 4% per year). The project would also require net operating working capital equivalent to 10% of the following year's sales revenue from the printers.

The CEO suggests that if the additional equipment were to be financed by debt, the interest cost would be $7 million per year.