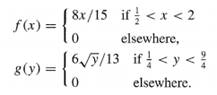

Mr. Jones has two jobs. Next year, he will get a salary raise of X thousand dollars from one employer and a salary raise of Y thousand dollars from his second. Suppose that X and Y are independent random variables with probability density functions f and g, respectively, where

What are the expected value and variance of the total raise that Mr. Jones will get next year?