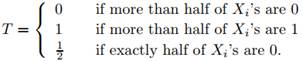

Let X1, ..., Xn be i.i.d. binary random variables with P(Xi = 1) = θ, where θ ∈ (0, 1) is unknown and n is an even integer. Consider the problem of testing H0; θ ≤ 0.5 versus H1; θ > 0.5 with action space {0, 1} (0 means H0 is accepted and 1 means H1 is accepted). Let the loss function be L(θ, a) = 0 if Hj is true and a = j, j = 0, 1; L(θ, 0) = C0 when θ > 0.5; and L(θ, 1) = C1 when θ ≤ 0.5, where C0 > C1 > 0 are some constants. Calculate the risk function of the following randomized test (decision rule):