Individual Assignment Risk Management

Question 1:

The pre-tax profit of a company is uncertain and is either EUR - 50 (a loss) or EUR 250 (a profit), both with a probability of 0.5. The corporate tax schedule is the following: in case of a loss, there are no tax payments. In case of a profit, the tax rate is 40 percent. Suppose the company can eliminate the risk of the profits (i.e. through hedging for no costs) and can instead realize a certain profit of EUR 100. By how much does risk management reduce the expected tax burden? Explain briefly the results. Do you find real life examples in which tax decisions might increase the firm value?

Question 2: Core risks

A bank's core business is trading financial derivatives e.g. interest rate swaps and fx forwards with corporate clients. The derivatives are used for hedging purposes. The following risk and return numbers for the trading portfolio are given for the last year. The return of 9 from market risk is driven by 8 from commission income and 1 by income from open position (proprietary trading).

|

|

Risk

|

Return

|

|

Market Risk e.g. from basis risk

|

10

|

9

|

|

Counterparty risk e.g. from derivatives business

|

10

|

-6

|

|

Total risk in the trading portfolio after diversification

|

15

|

3

|

a. What is the core competence and what is the core risk of the trading department?

b. Losses in counterparty risk occurred because of a couple of defaults of corporate clients. The CEO states, that this risk is core, whereas the chief trader states that it is non-core. What is your opinion? What could the bank do to mitigate this risk?

Question 3: Hedging

Lufthansa needs to buy oil for US$ 10 million in three months time. Interest rate for T=0.25 years (3 months) in US $ is 0.27% and the € interest is 0.77%. The current spot FX is SFX,0=1.31. Current oil spot price is SComm,0=100.

a) For a full fx hedge, what would be the appropriate forward position? Assume, so far that the commodity risk is fully hedged.

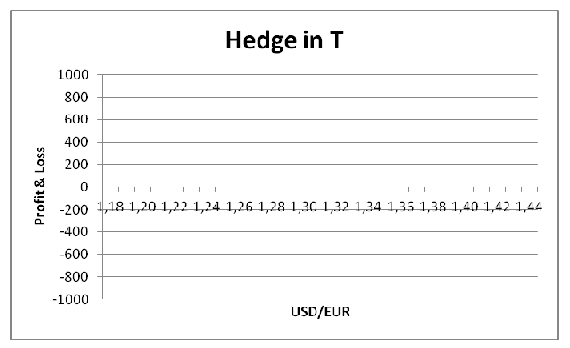

b) What is the total profit & loss in T (after 3 months) of the hedged position?

c) The bank takes a forward commission of 10 basispoints (1 basispoint = 0.01 %) on the forward price. What is the overall cost of the hedge?

d) The company considers an option hedge as an alternative. What would be the appropriate option position? Illustrate graphically (see below) the profit and loss for the spot position, the forward, the option and the total positions (one for the forward hedge, one for the option hedge). What are the main advantages and disadvantages of an option hedge?

e) What is the oil forward price FComm,0 for a convenience yield y = 6 % p.a.? What is the economic interpretation of this yield?

Note: FComm,0 = (SComm,0+U ) *(1+rUSD-y)T, with U as the face value of storage costs, one year storage costs are 2 $ (paid at the end of three months).

f) Lufthansa wants to hedge its kerosene risk using oil contracts. Explain the basis risk for this strategy.

g) Lufthansa decides not to hedge the commodity risk. How might this impact the fx hedge?

Question 4: Financial Crisis

The financial crisis was caused in the beginning by liquid asset backed securities turned illiquid. How did this risk turn into funding problems of banks? Explain briefly the market illiquidity problem and the funding problem of banks? How could this impact the loan lending business of the bank?