In this homework assignment, you will be working through two crashing problems and four earned value problems. All the information you need is included within this Homework packet. Make sure you answer all parts of the questions in their entirety.

Once you have worked through the problems, please post your responses to the Dropbox. Please refer to the course Syllabus for the due date.

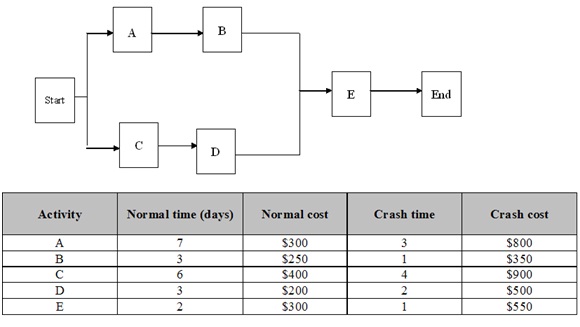

PROBLEM 1

Use the network diagram below and the additional information provided to answer the corresponding questions.

a) Give the crash cost per day per activity.

b) Which activities should be crashed to meet a project deadline of 10 days at minimum cost?What is the cost impact of crashing these activities?

c) Find the new budget (or cost of the project).

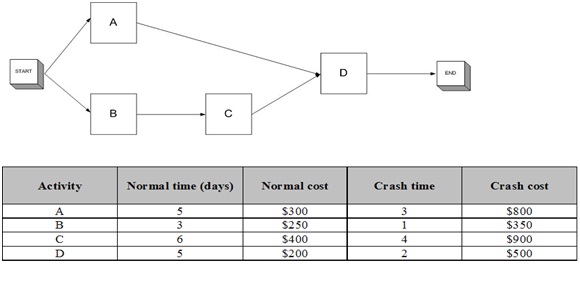

PROBLEM 2

Use the network diagram below and the additional information provided to answer the corresponding questions.

a) Give the crash cost per day per activity.

b) Which activities should be crashed to meet a project deadline of 13 days at minimum cost? What is the cost impact of crashing these activities?

PROBLEM 3 (8 points)

|

Month

|

AC

|

PV

|

EV

|

|

22

|

$540

|

$523

|

$535

|

a) Calculate the cost variance (CV).

b) Is the CV over or under budget?

c) Calculate the schedule variance (SV).

d) Is the SV ahead of or behind schedule?

PROBLEM 4

|

Month

|

AC

|

PV

|

EV

|

|

5

|

$34

|

$42

|

$39

|

a) Calculate the cost performance index (CPI).

b) Is the project cost efficient or not efficient?

c) Calculate the schedule performance index (SPI).

d) Is the schedule efficient or not efficient?

PROBLEM 5

|

Day

|

AC

|

PV

|

EV

|

|

65

|

$550

|

$735

|

$678

|

a) Calculate the cost variance (CV).

b) Calculate the cost performance index (CPI).

c) Calculate the schedule variance (SV).

d) Calculate the schedule performance index (SPI).

e) Given these data, what should a project manager do with respect to this project?

PROBLEM 6

|

Day

|

AC

|

PV

|

EV

|

|

65

|

$760

|

$735

|

$678

|

a) Calculate the cost variance (CV).

b) Calculate the cost performance index (CPI).

c) Calculate the schedule variance (SV).

d) Calculate the schedule performance index (SPI).

e) Explain the project performance in terms of efficiency, budget, and schedule. What should the project manager do for the project?