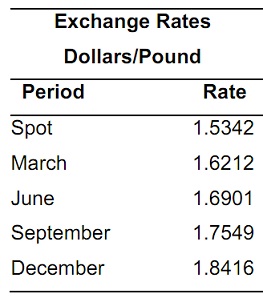

problem 1: The bank customer will be going to London in June to purchase Rs.100,000 in new inventory. The present spot and futures exchange rates are:

The customer enters to a position in June futures to fully hedge her position. When June arrives, the actual exchange rate is $1.725 per pound. How much did she save?

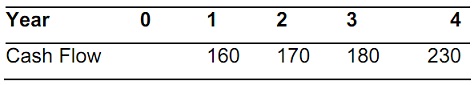

problem 2: Consider the given cash flows. All market interest rates are 12%:

Required:

a) What price would you pay for such cash flows? What total wealth do you expect after 2½ years if you sell the rights to the remaining cash flows? Suppose interest rates remain constant.

b) What is the duration of such cash flows?

c) Instantly after buying such cash flows, all market interest rates drop to 11%. Determine the impact on your total wealth after 2½ years?

problem 3: Ebay, Inc. went public in September of 1998. The given information on shares outstanding was listed in the final prospectus filed with the SEC1.

In IPO, the Ebay issued 3,500,000 new shares. The initial price to the public was $18.00 per share. The final first-day closing price was $44.88.

a) If the investment bankers retained $1.26 per share as fees, what were the total proceeds to Ebay? What was the market capitalization of new shares of the Ebay?

b) Two general statistics in IPOs are under pricing and money left on the table. Under pricing is defined as percentage change between the offering price and the first day closing price. Money left on the table is the difference between the first day closing price and the offering price, multiplied by the number of shares offered. Compute the under pricing and money left on the table for Ebay. What does this propose about the efficiency of the IPO process?

problem 4: If stock prices didn’t follow a random walk, there would be unexploited profit opportunities in the market. Is this statement true, false or uncertain? Describe your answer.