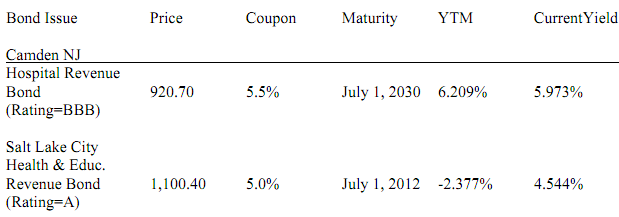

1) If interest rates rise over the next year, which bond will lose the most value? Why?

2) Explain why the higher rated bond, Salt Lake City Revenue Bond, has a negative yield to maturity (YTM).

3) Without adequate bond insurance, the Camden, NJ bond would carry a less desirable B Rating. If the bond insurance were dropped, what would be the effect on the bond's Price and YTM?

Novartis (NVS) currently pays a dividend of $2.46 per share each year on its common stock. It has maintained steady 12.2% growth in dividend payments in recent years and expects to do so in the future. If the required rate of return (Re) for NVS is 17%, calculate the present value (fundamental value) of the company's common stock.

The current market price for NVS is $57.17 per share. Based on your valuation analysis above would you consider NVS over or undervalued?

Corporate Cost of Capital

A certain healthcare conglomerate has the following target capital structure:

and senior management is interested in finding the company's Corporate Cost of Capital. The company's debt is in the form of bonds each with par value of $1,000, a coupon rate of 5.5 percent, and 20 years to maturity. These bonds pay interest on a semi-annual basis. The company pays a dividend of $1.30 per share on its preferred stock and pays a dividend of $1.15 per share on its common stock. The common stock's dividend is expected to grow at a constant 3 percent per year in the future. Assume the company currently bears a corporate tax rate of 40 percent and its stock returns have a risk premium of 4.5 percent over the cost of the company's debt. Analysts have estimated the company's market risk (beta) to be 0.9. Current market prices for the company's bonds and stock are given below:

The U.S. Treasury bond and common stock markets seem to indicate that the risk free rate of return is 3.2 percent and the return on the overall market for stocks is 9.4 percent.

5) Based on the information provided above, calculate the company's Corporate Cost of Capital.

Then briefly describe how each of the following independent events would affect the company's cost of capital:

6) a rise in the market price of the company's common stock

7) a drop in the corporate tax rate

8) a strategic shift in the company's business that increases the overall riskiness of the firm.

Capital Budgeting Basics

A 250 bed, investor owned hospital in south Florida is currently evaluating a proposal to build a new outpatient surgery center. The hospital has experienced significant growth in demand for outpatient surgery services and believes the new center will meet this need while providing additional returns. The estimated land, building, equipment, and installation costs total $10,200,000. The initial cost for the project would occur in Year 0. The project is expected to generate new net incremental cash flows for the hospital for 5 years. The final cash flows are listed below:

Management also expects the project to have a net after tax salvage cash flow of $3,420,000 in Year 5 in addition to the listed cash flows. (Note: These figures have already accounted for all revenues, costs, taxes, and depreciation associated with the project). The hospital faces a corporate cost of capital of 10% per year.

Questions

Calculate the project

9) Net Present Value (NPV)

10) Internal Rate of Return (IRR)

11) Payback Period

Discuss whether this project would add value for the hospital's investors based on your results.

Question 12

Now assume that a more detailed analysis of the project showed a higher initial cost of $11,300,000 in Year 0 and a net salvage cash flow in Year 5 of $2,040,000. Recalculate the NPV, IRR, and Payback period for the project and discuss whether the project would add value for the hospital's investors under these new assumptions.