Hughes International is a U.S. company that conducts business throughout the world. Listed below are selected transactions entered into by the company during 2011.

1. Sold merchandise to Royal Equipment Company (a United Kingdom company) in exchange for an account receivable in the amount of 320,000 pounds. At the time, the exchange rate was 0.50 British pound per U.S. dollar.

2. Sold merchandise to Honda Automobile Company (a Japanese company) in exchange for a note receivable that calls for a payment of 350,000 yen. The exchange rate was 125 yen to the U.S. dollar.

3. Purchased inventory from Venice Leathers (an Italian company) in exchange for a note payable that calls for a payment of 500 euros. The exchange rate was 0.75 euro to the U.S. dollar.

4. Purchased inventory from B. C. Lumber (a Canadian company) in exchange for an account payable in the amount of 200,000 Canadian dollars. The exchange rate was 1.10 Canadian dollars per U.S. dollar.

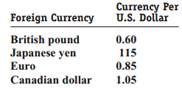

On December 31, 2011, the exchange rates were as follows:

REQUIRED:

a. Convert each transaction above to the equivalent amount in U.S. dollars.

b. Prepare journal entries to record each transaction.

c. Assume that the receivables and payables are still outstanding as of December 31, 2011.

Compute the amount of exchange gain or loss for each transaction.

d. Why do fluctuating exchange rates give rise to exchange gains and losses?