problem 1: Judy Johnson is choosing between investing in two Treasury securities which mature in five years and have par values of $1,000. One is a Treasury note paying an annual coupon of 5.06 percent. The other is a TIPS that pays 3 % interest annually.

a) If inflation remains constant at 2 % annually over the next 5-years, what will be Judy’s annual interest income from the TIPS bond? From the Treasury note?

b) How much interest will Judy receive over the 5-years from the Treasury note? From the TIPS?

c) When each bond matures, what par value will Judy receive from the Treasury note? The TIPS?

d. After 5-years, what is Judy’s total income (interest + par) from each bond? Should she utilize this total as a way of deciding which bond to purchase?

problem 2: Suppose that a $1,000 face value bond has a coupon rate of 8.5 percent, pays interest semi-annually, and has an 8-year life. If investors are willing to accept a 10.25 % rate of return on bonds of similar quality, what is the present value or worth of this bond?

problem 3: The Garcia Company’s bonds have a face value of $1,000, will mature in 10-years, and carry a coupon rate of 16 %. Suppose interest payments are made semi-annually.

a) Find out the present value of the bond’s cash flows if the required rate of return is 16.64 %.

b) How would your answer change if the required rate of return is 12.36 %?

problem 4: Mercier Corporation’s stock is selling for $95. It has just paid a dividend of $5 s share. The expected growth rate in dividends is 8 %.

a) Find out the required rate of return on this stock?

b) By using your answer to (a), assume that Mercier announces developments that should lead to dividend increases of 10 % annually. What will be the new value of Mercier’s stock.

c) Again by using your answer to (a), suppose developments take place that leave investors expecting that dividends will not modify from their current levels in the foreseeable future. Now what will be the value of Mercier stock?

d) From your answers to (b) and (c), how significant are investor's expectations of future dividend growth to the current stock price?

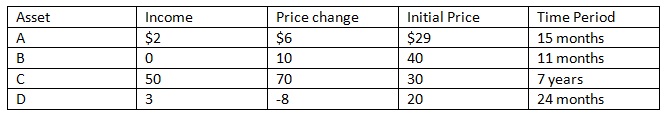

problem 5: Given the information below, compute annualized returns: