Here are some general questions and instructions to test your understanding of the mean standard deviation diagram.

a. Draw a mean-standard deviation diagram to illustrate combinations of a risky asset and the risk-free asset.

b. Extend this concept to a diagram of the risk-free asset and all possible risky portfolios.

c. Why does one line, the capital market line, dominate all other possible portfolio combinations?

d. Label the capital market line and tangency portfolio.

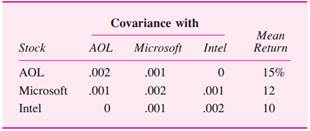

e. What condition must hold at the tangency portfolio? Exercises 5.2-5.9 make use of the following information about the mean returns and covariances for three stocks. The numbers used are hypothetical.