FRL 383

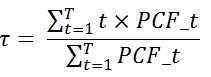

1. The average life τ of a bond is defined as

where PCFt is the principal cash flow at time t, and T is the maturity of the bond.

a. What is the average life of a zero-coupon bond?

b. What is the average life of an interest only bond?

c. Consider a fully amortizing level-payment mortgage that does not default, nor is it ever curtailed or prepaid.

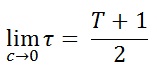

i. Show that

where c is the mortgage contract rate.

ii. Make a graph of the average life vs the contract ratec, where 0≤c≤100% and T=30y. In you submission, show the amortization table for c=5% (and make sure it fits on one page and is annotated)

2. Consider a $100,000 fully amortizing 30-year 5/1 ARM with a margin of 2.5%. The note rate for the fixed period is 4%, and suppose that the underlying index has values of (date in years, rate as MEY): (0, 2%), (1,2.5%), (2,2.5%),(3,2%),(4,2%),(5,2%),(6,4.5%), and (7-30,5%).

Rate caps are 1/3 (periodic/lifetime), but the fixed to floating cap is 2%. The is also a payment cap of 10%, with a negative amortization cap of 120%.

If the fees for the loan are 2% and $3,000, what is the loan's APR?

3. A borrower is faced with choosing between two fully amortizing level-payment loans. Loan A is available for $75,000 at 10% MEY for 30 years, with 6 points included in the closing costs. Loan B would be made for the same amount, but at 11% MEY for 30 years, with 2 points included in the closing costs. Neither loan defaults/is curtailed.

a. If the loan is to be repaid after 15 years, which is the better choice?

b. If the loan is repaid after 5 years, which is the better choice?

Hint: Use the effective cost of borrowing to make the decision.

4.

A. Describe the model of firm equity as a call option on assets of the firm. What does it mean for this option to be "out-the-money?"

B. Why were many thrifts insolvent by the early 1980's?

C. Using the equity model in A, and the concept of forbearance, describe and explain the behavior of thrifts, both insolvent and solvent, in the early 1980's.

D. How does securitization help mitigate the problem described in B?

E. Describe how securitization eventually played a role in the creation of the "RE bubble" of the early- to mid-2000's.