For the discrete-time process Xn in Problem 11.2.2, calculate an approximation to the power spectral density by finding the DFT of the truncated autocorrelation function

Compare your DFT output against the DTFT SX (φ).

Problem 11.2.2

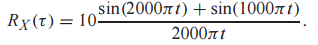

X(t) is a wide sense stationary process with autocorrelation function

The process X(t) is sampled at rate 1/Ts = 4,000 Hz, yielding the discrete-time process Xn. What is the autocorrelation function RX [k] of Xn?