Financial Modelling

PowerTool is the largest US manufacturer of industrial hand tools. Its sales force is strong but clients have complained that marketing is weak. The industrial tool business is mature, with little or no future expected growth.

PowerTool has acquired Fenton Manufacturing, a small innovative company whose sales are entirely in the retail tool market. The retail tool market is expected to grow at a 5% annual rate.

Fenton recently developed a patented line of rechargeable home power tools that displayed strong potential in test markets. Fenton expects this line to generate 50 percent of its sales within five years, but lacks a sales force to market this product line. Jerry Fenton, the company's founder, recently retired.

PowerTool management is highly respected and the company has experienced little management turnover. However, the Chief Executive Officer has announced her retirement after 18 years of service, and will be replaced by the current Chief Operating Officer.

You are a private investor with a large investment in PowerTool bonds and shares, and wish to determine the effect of the acquisition of Fenton on PowerTool's bonds and other related issues.

Question 1

PowerTool has a 6% coupon semi-annual bond with 3 more years to maturity.

(a) The market price is $108. What are the Current Yield and Yield-to-Maturity (YTM) of this bond?

(b) What is the Modified Duration of this bond when the market yield is at YTM

(c) Explain why and when Modified Duration under-predicts and over-predicts the change in bond price as the market yield changes.

(d) Suppose this is a callable bond and has only one call date happens 1 year from now. The call price is at $105. Would investors still pay $108 for this bond? Higher or lower? Explain.

(e) If investors still pay $108 for it, and the bond is called. What is the YTM of this investment?

(f) Explain what market conditions under which PowerTool would likely call its bond.

Question 2

PowerTool has a $12 strike European call option on its stock, is trading at $2.40 when the underlying is at $13.60. This option will expire in 6 months time. The risk-free rate is 4%.

(a) With the given call option and the Solver in EXCEL, estimate the implied volatility of PowerTool. (Note: PowerTool is a non-dividend paying stock).

(b) With the EXCEL spread sheet setup in part (a), determine the premium of the corresponding put option.

(c) Henceforth, verify the Put-Call Parity identity.

(d) What is the Delta of this put option?

(e) With the EXCEL spread sheet setup in part (b), re-determine the put option premium when the underlying is $13.55.

(f) Verify your results from part (b) and (e) with that of part (d).

Question 3

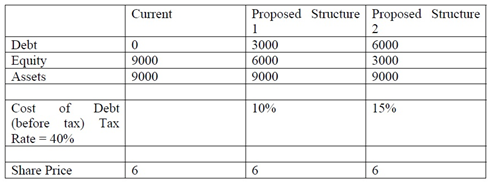

Assuming that PowerTool has called its bond and therefore there is no debt in its current capital structure. It is studying two possible structures with debt being further introduced. The details are given in the following table:

Shares Outstanding 1 1500 1 1000 I 500

(a) Given Earning Before Interest & Tax (EBIT) = $1200, based on the information in the table, which capital structure should PowerTool adopt?

(b) Plot the EPS (Y-axis) vs EBIT (X-axis) chart (with EXCEL), thereby determine the cross-over EBIT that PowerTool would switch from one structure to the other?

(c) Determine the Return on Equity (ROE) for both structure 1 and 2. Explain why the use of debt (Le. financial leverage) in Structure 2 decreases both ROE and EPS instead?

(d) Assuming EBIT is fixed at $1200 and tax rate 40%, by varying the debt cost at 4%, 10% and 20% in Structure 1, plot the line ROE (Y-axis) vs Debt Cost (X-axis) with EXCEL, thereby determine the cost of debt threshold that use of more debt will NOT improve the 8% ROE when the finn is unlevered.

Question 4:

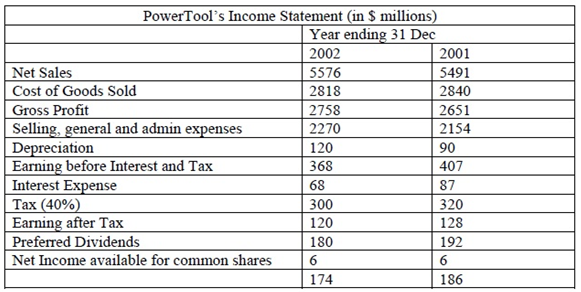

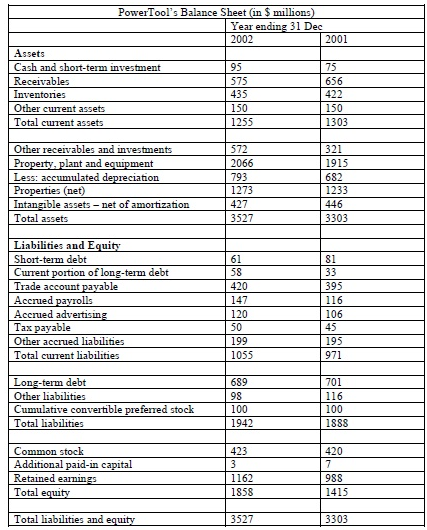

a) With the EXCEL spread sheet, determine the Cash Flow from Assets, Cash Flow to Creditors and the Cash Flow to Stockholders.

(b) With the cash flows obtained in part (a), verify that the following identity holds: Cash Flow from Assets = Cash Flow to Creditors + Cash Flow to Stockholders.

(c) Prepare the Fund Flow Statement (Source and Use) for the year 2002.

(d) Comment on the health of PowerTool by examining the three ratio components in the DuPont Identity.