Financial Management of Corporations Agree / Disagree Essay Questions

Agree/disagree questions test whether you can apply the definitions, concepts and procedures. The questions in this exercise relate to Chapter 11. Agree/disagree questions begin this way:

"Agree or disagree with the statement in italics and defend your position with the strongest arguments you can marshal."

A good answer begins either "I agree because..." or "I disagree because..." and then goes on to state reasons for your position. Good answers are usually 3-5 sentences long. Many answers can be illustrated with a diagram or a mathematical equation. Questions similar to those on the final exam follow.

1. A rational investor is thinking of investing in a portfolio composed of two assets: Assets S and B. E(RS) is 20% and σS is 40%; E(RB) is 6% and σB is 10%. The assets' returns are uncorrelated, i.e., ρSB is zero. A rational investor should hold some combination - any combination - of Assets S and B so as to reduce risk.

2. A rational investor is thinking of investing in a two-asset portfolio. The more highly correlated are the returns on the two assets, the greater the reduction in risk possible from investing in the portfolio.

3. An analyst has computed the expected returns and standard deviations of return for two stocks for the coming twelve months: E(R1), E(R2), σ1 and σ2. The expected return on a portfolio composed of the two stocks, E(RP),always lies between E(R1), E(R2) but the standard deviation of the return on the portfolio, σp, does not necessarily lie between σ1 and σ2.

4. The capital market has a large number of capital assets (stocks and bonds) but lacks a risk-free asset. A rational investor should hold a portfolio - any portfolio - with a large number of assets so as to reduce risk.

5. The variance of the return on a portfolio containing four capital assets ( σ2P ) depends at least as much on the covariances among the assets' returns as on the variances of the assets' returns.

6. A capital market has N capital assets, where N is a very large number. Starting with a 1-asset portfolio, increasing the number of assets in the portfolio from 1 to N drives the variance of the portfolio's return, σP2, to zero.

7. Chapter 10 reports that for the 1926-2008 time period a mutual fund containing stocks of the 500 largest US companies had a standard deviation of annual returns (σP) of 21% whereas a mutual fund containing stocks of the 2,000 smallest companies traded on the New York Stock Exchange had a σP of 33%. The small-stock portfolio is riskier because small companies have more unique risk than large companies.

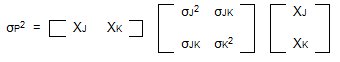

8. The variance of the return on a portfolio with two stocks, Stocks J and K, may be written in matrix notation as follows:

As the number of stocks in a portfolio increases, the contribution of a single stock's variance to the variance of the return on the portfolio declines towards zero, whereas the contribution of the stock's covariance to the variance of the return on the portfolio does not.

9. The capital market has a large number of (risky) capital assets but lacks a risk-free asset. If a risk-free asset were to become available, most investors would chose to invest in it because doing so would improve their investment outcomes.

10. Any portfolio composed of a large number of capital assets could be called "the market portfolio".

11. A capital market has a large number of (risky) capital assets plus a risk-free asset. The portfolios rational investors hold are more similar than the portfolios they would hold if the risk-free asset disappeared.

12. A capital market has a large number of capital assets plus a risk-free asset. Rational investors who are willing to bear high risks to get high returns should hold portfolios with a small number of assets - say, 5 -- having very high standard deviations.

13. The market portfolio has N capital assets, where N is a large number. Adding one more capital asset to the market portfolio always reduces the risk of the market portfolio, as measured by σ2M, by making the market portfolio more diversified.

14. Advanced Technologies (AT) is a successful producer of industrial chemicals. The experiments needed to develop a certain new chemical have raised the risk of a devastating accident at the company's main laboratories. Although AT has purchased additional insurance, an accident could disrupt the company's normal operations. The risk to AT's operations from the new product development program should mean a higher expected return for AT stockholders.

15. A capital market has a large number of capital assets plus a risk-free asset. Investors who choose to hold portfolios with a small number of capital assets can expect to earn higher rates of return on their portfolios - as well as the assets in their portfolios - because their portfolios are less well diversified and, hence, riskier.

16. The capital market line and the security market line are unrelated to one another.

Attachment:- Assignment Files.rar