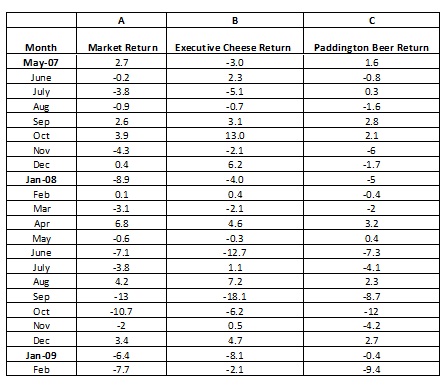

1. Abnormal Returns

Column (A) below shows the monthly return on the British FTSE 100 index from May 2007 through February 2009. Columns (B) and (C) show returns on the stocks of two firms- Executive Cheese and Paddington Beer. Both firms announced their earnings in February 2009. Calculate the average abnormal return of the two stocks during the month of the earnings announcement.

2. Underpricing - construct a simple example to show the following:

a. Existing shareholders are made worse off when a company makes a cash offer of new stock below the market price.

b. Existing shareholders are not made worse off when a company makes a rights issue of new stock below the market price even if the new stockholders do not wish to take up their rights.

3. Dividends and Taxes-

a. Which of the following U.S. investors have tax reasons to prefer companies that pay out cash by repurchase instead of cash dividends?

b. Which should not care?

- A pension fund

- An individual investor in the top income- tax bracket

- A corporation

- An endowment for a charity or university

4. Dividend Policy- Investors and financial managers focus more on changes in cash dividends than on the level of cash dividends. Why?