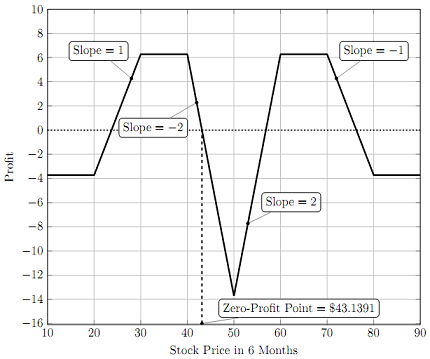

Exercise 1 - Below is a profit diagram for a position. This position involves trading options with 6-months maturity on a stock with current stock price $50, paying dividends at rate δ = 1%. The continuously-compounded risk-free rate is 5%.

a) In the table below, report the number of options (for each strike price) needed to construct the diagram-if you need to buy n options write +n and if you need to write n options write -n. Use put options only. The relevant slopes are displayed on the diagram.

|

Strike Price

|

20

|

30

|

40

|

50

|

60

|

70

|

80

|

|

Number of Puts

|

|

|

|

|

|

|

|

b) What is the initial cash-flow required to establish this position (i.e., what is the premium of this position)?

c) Consider the put positions in a) suppose you set your position in the 40-strike, the 50-strike, and the 60-strike puts to zero, keeping other positions unchanged. Draw the payoff diagram of the resulting strategy.

d) Suppose the stock price volatility is 0: What is the payoff of the strategy under a) and d) respectively? What if the stock price falls to $30 in 6 months?

Exercise 2 - Suppose you want to price a call option with strike price $95 and 1-year to maturity. The risk-free rate is 8% and the underlying stock pays dividends at a continuously-compounded dividend yield of 8%. The stock price evolves according to the 2-period binomial tree:

a) What is the annualized volatility used to compute the tree?

b) Price the European call option by completing the tree below.

c) What is the risk-neutral probability that the option ends up in-the-money?

d) If the call had a knock-in barrier set at $140, what would the risk- neutral probability be that the call gets knocked-in at maturity?

e) What is the risk-neutral probability that the running minimum mink∈{0,1,2}Sk over the life of the option is $100?

f) What is the risk-neutral probability that the arithmetic average ½k=1∑2Sk of the stock price is $90?

g) Suppose the Wall Street Journal quotes a price of C0 = $15 for the European call today-assume the option is correctly priced at the end of the first period. In the table below, explain the transactions you undertake to arbitrage current option mispricing. In the third column, show that your strategy has zero cash-flow both in the up-and down-node.

|

|

Cash Flows

|

|

|

Time 0

|

Period 1

|

|

|

|

u

|

d

|

|

|

|

|

|

|

Total

|

|

|

|

h) Price the American call option by completing the tree below. Circle the node(s) at which you exercise.

Exercise 3 - Suppose you are in the Black-Scholes world and you consider a put with strike price $105 and a 4-months maturity. The non-dividend-paying stock has current value $100 and volatility σ = 0.5. The continuously-compounded risk-free rate is 7%.

a) Compute the put premium.

b) Compute the premium for the 105-strike 4-months call using the put-call parity.

Suppose the Wall Street Journal quotes a put premium of $14 today-assume the put is correctly priced tomorrow. Consider now 2 possible scenarios: the stock price tomorrow is $120-scenario A-or $95-scenario B. Ignore interest expenses.

c) In the table below, show that short-selling the put and taking a delta- replicating position in shares does not allow you to make an arbitrage profit. Complete line 1 by reporting the mark-to-market profits on the short put. On line 2, indicate your position in the stock (first column), the number of shares traded (second column), and the daily profits on these shares (third column). On line 3, report your total daily profits.

|

Transaction

|

Position (number)

|

Daily Profits

|

|

Today

|

Tomorrow

|

|

Scenario A

|

Scenario B

|

|

1. Sell 1 put

|

-1

|

|

|

|

2.

|

|

|

|

|

3. Total

|

|

|

|

d) To obtain an arbitrage profit, you need your strategy to be gamma- neutral. To do so, consider a correctly-priced at-the-money 6-months call: compute the number of calls you need to buy or sell for your arbitrage strategy to be gamma-neutral.

e) In the table below, show that a gamma-neutral delta-replicating strategy generates an arbitrage profit. Complete line 1 by reporting the total daily profits computed under c). On line 2, indicate your position in the call (first column), the number of calls traded (second column), and the daily profits on these calls (third column). Buying the call distorts your delta-replicating strategy-on line 3, indicate the number of additional shares you need to trade to offset the call distortion (second column) and the profits you make on these shares (third column). On line 4, report your total daily profits.

|

Transaction

|

Position (number)

|

Daily Profits

|

|

Today

|

Tomorrow

|

|

Scenario A

|

Scenario B

|

|

1. Δ-replicating strategy

|

|

|

|

|

2.

|

|

|

|

|

3.

|

|

|

|

|

4. Total

|

|

|

|

Exercise 4 - Suppose a publicly-traded firm XYZ, currently trading at €35, surprises market-makers by announcing a special one-time dividend of €5 paid in 1 month from now-e.g., in 1998, Daimler-Benz announced a dividend ten times larger than the usual payout. Assume the continuously-compounded rate on a euro-denominated bond is 3% and consider a forward contract that expires in 4 months.

a) Compute the no-arbitrage forward price of firm XY Z in euros.

b) Suppose market-makers decide to ignore the one-time dividend paid by XYZ. Compute the forward price they would accordingly quote in euros.

c) The quoted price you computed under b) implies an arbitrage opportunity. In the table below, explain the transactions you undertake to obtain a zero profit at time 0 and a positive profit in 4 months-state each transaction in the first column and report the associated cash-flow in the relevant columns. Report your total cash-flow at the bottom of each column. All transactions are undertaken in euros.

|

|

Cash Flows

|

|

|

Time 0

|

Time 1 month

|

Time 4 months

|

|

|

|

|

|

|

Total

|

|

|

|

d) XYZ is a German firm and you are a US-based investor-you wish to convert your 4-months arbitrage profits under c) into dollars. Suppose the current $/€-exchange rate is 1.33 and the continuously-compounded rate on dollar- denominated bonds is 5%. What is the dollar value of your arbitrage profits in 4 months?

Suppose now that XY Z produces a commodity that currently trades at 30$. The Wall Street Journal quotes a 3-months forward price of 33$ for this commodity.

e) Compute the implied lease rate for this commodity.

f) Suppose that, in this commodity market, storage is optimal and that the highest no-arbitrage forward price is 38$. Compute the implied continuously- compounded rate of storage costs and the convenience yield.

g) If the lease rate and the risk-free rate are constant over time, is this commodity market in contango or in backwardation? Explain.

Exercise 5 - Consider an at-the-money call and an at-the-money put both with a T -year maturity. The non-dividend-paying stock has current value S0 and volatility o. The continuously-compounded risk-free rate is r.

a) Assuming that S0 = 70, σ = 0.6, r = 5%, and T = 2, compute the Black-Scholes premium for both the put and the call.

You currently have no view on the future direction of the market-you wish to enter a T -year contract today that allows you to decide whether the contract will be a put or a call in 0 < t < T year from now. This contract is called a chooser option.

b) Using put-call parity, show that the chooser option is worth

Ct + max(Ke-r(T-t) - St, 0)

in t year, where Ct denotes the Black-Scholes call price at time t.

c) Find an expression for the current value of the chooser option.

d) Assuming t = 1 and using the parameter values under a), compute the current price of the chooser option.

e) What is the risk-neutral probability that you end up choosing a put in 1 year?