Economics and Finance

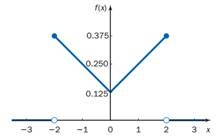

On any given trading day, the fluctuation, or change, in the price (in dollars) of JP Morgan Chase stock, listed on the New York Stock Exchange, is between 22.00 and 2.00. Suppose the change in price is a random variable with the probability density function shown below.

a. Verify that this is a valid probability density function.

b. What is the probability that the stock price increases by at least $1.00 on a randomly selected day?

c. What is the probability that the change in stock price is between 21.00 and 1.00?

d. Find a value c such that P( -c ≤ X ≤ c) = 0.90.